From idea to impact: scoring a policy reform on the new PolicyEngine UK

A walkthrough of the new app on a UK tax-benefit reform.

Contents

The landing page

Building a policy

Scoring the economic impact

Calculating a household’s impact

Last week saw the 10-year anniversary of the introduction of the Child Benefit High Income Tax Charge, which recoups the value of the Child Benefit from high-income parents. Let’s walk through how to estimate the impact of abolishing it.

The landing page#

The landing page now has a new look. We know that PolicyEngine users usually fall into two categories: people who want to calculate their household’s taxes and benefits (sometimes under a policy reform), and people who want to run economic analyses of custom-built policy reforms (and also simulate example households). So we’ve split these use-cases up on the landing page.

We’re interested in building a new reform, so we’ll select Compute the impact of policy reforms.

Building a policy#

The policy builder page on PolicyEngine.

On this part of the app, we can specify the details of our policy reform, and simulate it on the economy. There are three panes in this view.

The left pane is for navigation: use this to select what the middle pane should be showing. The top half is a menu of all the input parameters: policy parameters you can change to build a reform (for example, the basic rate of income tax). The bottom half is a menu of all the outputs: things the model can tell you about how your reform affects the economy (for example, the effect on poverty rates).

The middle pane shows different things depending on what you’ve selected in the left pane. If you select a policy parameter, it’ll give you the option to change that parameter. If you select an output, it’ll show you a chart and some explanation.

The right pane lets you control your policy reform at a high level: giving it a name, selecting where and when to simulate it, and against what baseline. You can also use this pane to move on from this screen and see how a specific household fares under a reform.

We want to build a reform that abolishes the High-Income Tax Charge: first, we need to select the right parameter. The left pane organises parameters by government department, so we could find it by navigating into HMRC > Income Tax > Tax charges.

But a faster way is to use the search bar in the top-left to jump straight to it. Search for Child Benefit Tax Charge and you’ll see two parameters: one for the rate at which Child Benefit is phased out, and one for the threshold at which this happens.

Searching for the Child Benefit Tax Charge parameter.

We’ll select the phase-out rate. The middle screen now shows that parameter: its title, description, and a graph of its value over time. This is one of the most powerful new features in PolicyEngine: the ability to specify a time-dated parametric reform to any degree of complexity. Instead of just being able to set a parameter’s value for the current year, you can set it for any time period, as many times as you’d like using the start-end date dialogue.

For now though, we’ll just set it to zero.

Abolishing the HITC phase-out rate.

You’ll notice the right sidebar has updated with a description of our reform, and it’s been auto-designated the name Policy #130. Let’s rename it to Abolishing the Child Benefit HITC by typing that into the name display in the top-right.

Now, we’re ready to see the economic analysis. Click on Calculate economic impact to see how it affects the UK in 2023.

Scoring the economic impact#

The middle pane now shows a menu of what the model can tell you: the effect on the budget, poverty impacts, distributional impacts and more. Navigating onto the budgetary impact chart, we can see that this reform costs £2bn.

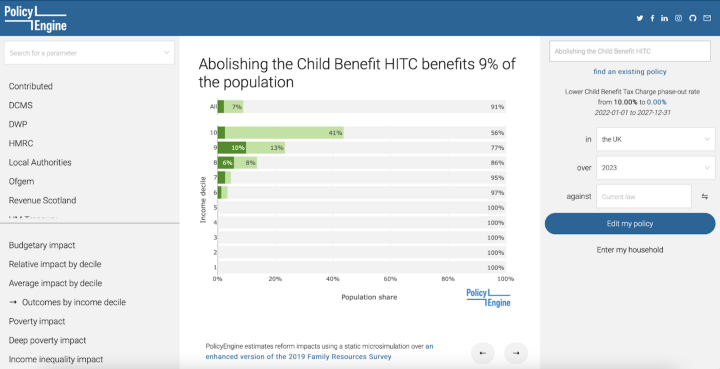

We can also look at the distributional impact, for example by selecting Outcomes by income decile. This reform mainly affects households in the top half of the income distribution, and the top decile sees the highest proportion of people affected by the reform.

Distributional analysis of the HITC abolition.

Calculating a household’s impact#

Economic analyses are important for understanding the broader picture of a reform over an entire country, but policy discussions often centre around specific examples or edge cases. We’ve streamlined the design of the household calculator on PolicyEngine to make it easier and faster to get the numbers out of the model.

Select Enter my household to jump into the household analysis page. This will take you to the household page (like you would have seen if you had selected Compute household impacts at the very start, but now with your policy saved).

The household calculator’s landing page.

This screen is set out just like the policy screen: the left pane is for navigation, and is split between inputs and outputs. The middle pane lets you change household properties instead of policy parameters, and the right pane now will show details about your household once you’ve entered them.

The household screen will now give you an option to start entering details about your household. Click through, and use the prompts given to specify a few basic details: adults and children, location, income and age (you’ll be able to add more later).

Once you’ve entered these, you’ll be taken straight to the Net income page, which tells you how your household is affected by the reform.

The net income screen.

This screen can tell us exactly why the household is affected like this: expand individual sections to trace down where the change comes from.

Another major new feature comes under the Varying your earnings option in the bottom left pane: the ability to see how specific properties of a household change in response to earnings, not just net income. Here, we can use it to see how the HITC changed by income, with and without the reform.

The HITC by income, under the abolition reform.

We can also see the impact on marginal tax rates: for a household with £55,000 income, abolishing the HITC lowers their MTR from 62% to 43%.

From here, you can go back and change any input variable (by the left navigation menu, or with the search box in the top left), go back and change the policy reform, or revisit any other part of the app.

Let us know what policy ideas you create, by tagging @ThePolicyEngine.

nikhil woodruff

PolicyEngine's Co-founder and CTO

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

PolicyEngine is a registered charity with the Charity Commission of England and Wales (no. 1210532) and as a private company limited by guarantee with Companies House (no. 15023806).

© 2025 PolicyEngine. All rights reserved.