New Ways to Give to PolicyEngine

Exploring state tax credits for charitable giving.

Contents

Maryland Venison Donation Credit

South Carolina Deer Processing Donation Credit

Maryland Oyster Shell Recycling Credit

Supporting PolicyEngine

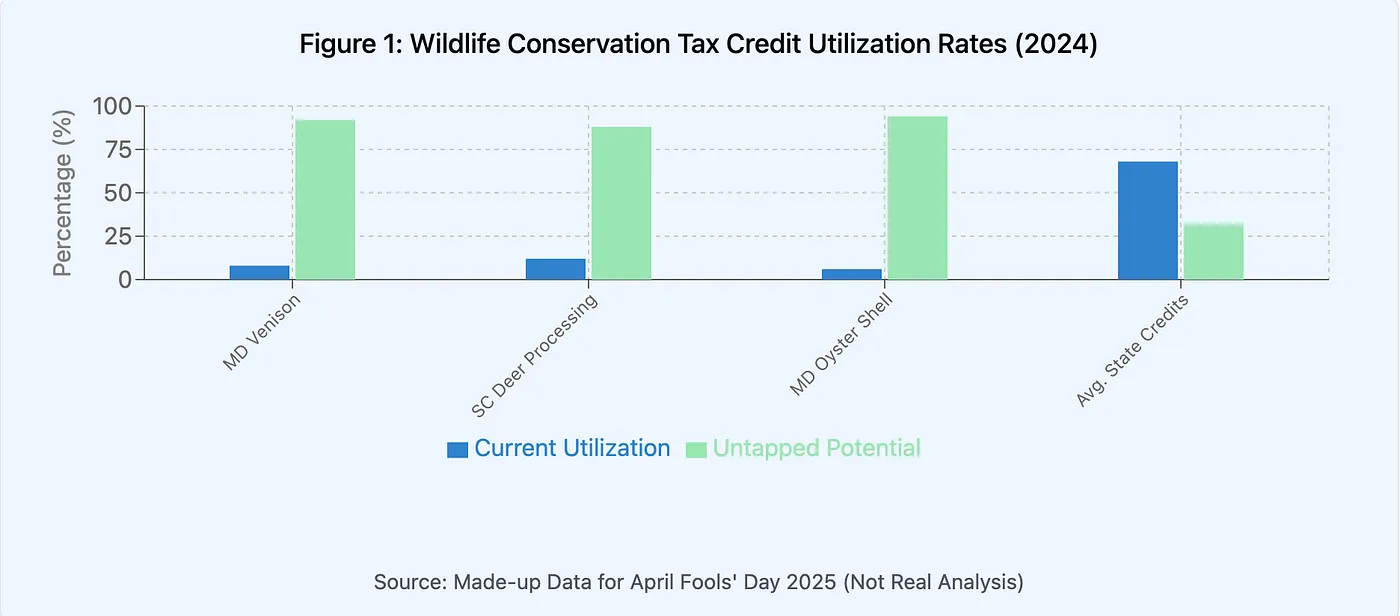

At PolicyEngine, our mission of democratizing policy analysis and modeling state tax policies relies significantly on charitable donations. Many states offer unique tax credits designed to encourage charitable contributions that support community needs. PolicyEngine is excited to begin accepting donations in more accessible ways than traditional cash donations.

Below, we highlight several state tax credits that donors can utilize to enhance their contributions:

Maryland Venison Donation Credit#

Maryland provides a

South Carolina Deer Processing Donation Credit#

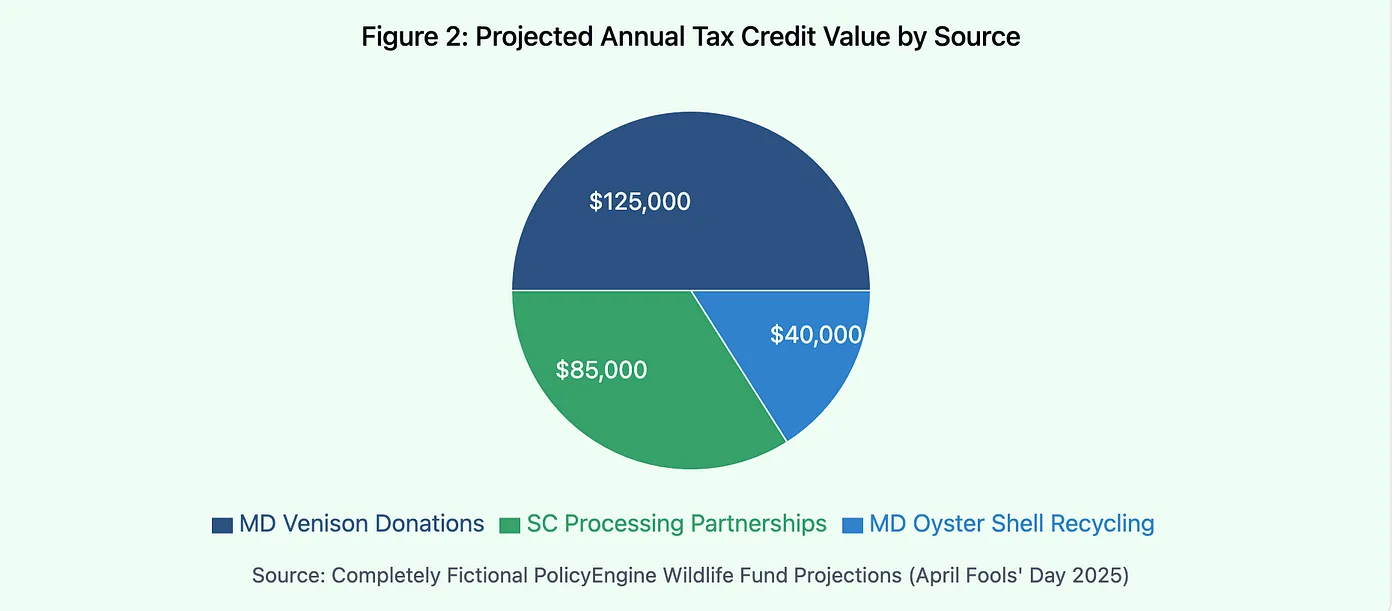

South Carolina incentivizes licensed meat processors to partner with nonprofit organizations, facilitating venison donations to help feed communities in need. The

Maryland Oyster Shell Recycling Credit#

Recognizing the ecological importance of oyster shell recycling, Maryland offers a credit for recycling oyster shells. Residents may claim $5 for each bushel of oyster shells recycled during the tax year, up to $1,500 per taxpayer.

Supporting PolicyEngine#

Utilizing these state tax credits enables donors to direct additional resources toward causes important to them, including PolicyEngine’s ongoing research and policy modeling efforts. By taking advantage of these credits, donors can optimize their financial planning while contributing meaningfully to their communities and beyond.

We invite our supporters to explore how leveraging state-specific tax credits can enhance their philanthropic impact. For additional information and traditional donation options, please visit our donation page at

Thank you for your continued support of PolicyEngine’s mission to advance evidence-based policymaking.

Note: This is an April Fools’ Day analysis. While these tax credits are real, PolicyEngine is not currently accepting wildlife donations. We do welcome your conventional financial support at

daphne hansell

Research Analyst at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.