Federal Tax Inflation Adjustments for Tax Year 2025

PolicyEngine has updated all relevant federal tax parameters based on the latest IRS announcements.

How does the IRS update tax parameters?#

Federal tax law requires inflation adjustments for certain tax parameters using the Consumer Price Index (CPI). The

What was updated?#

PolicyEngine has modeled most federal income tax provisions since 2022. Additionally, we use

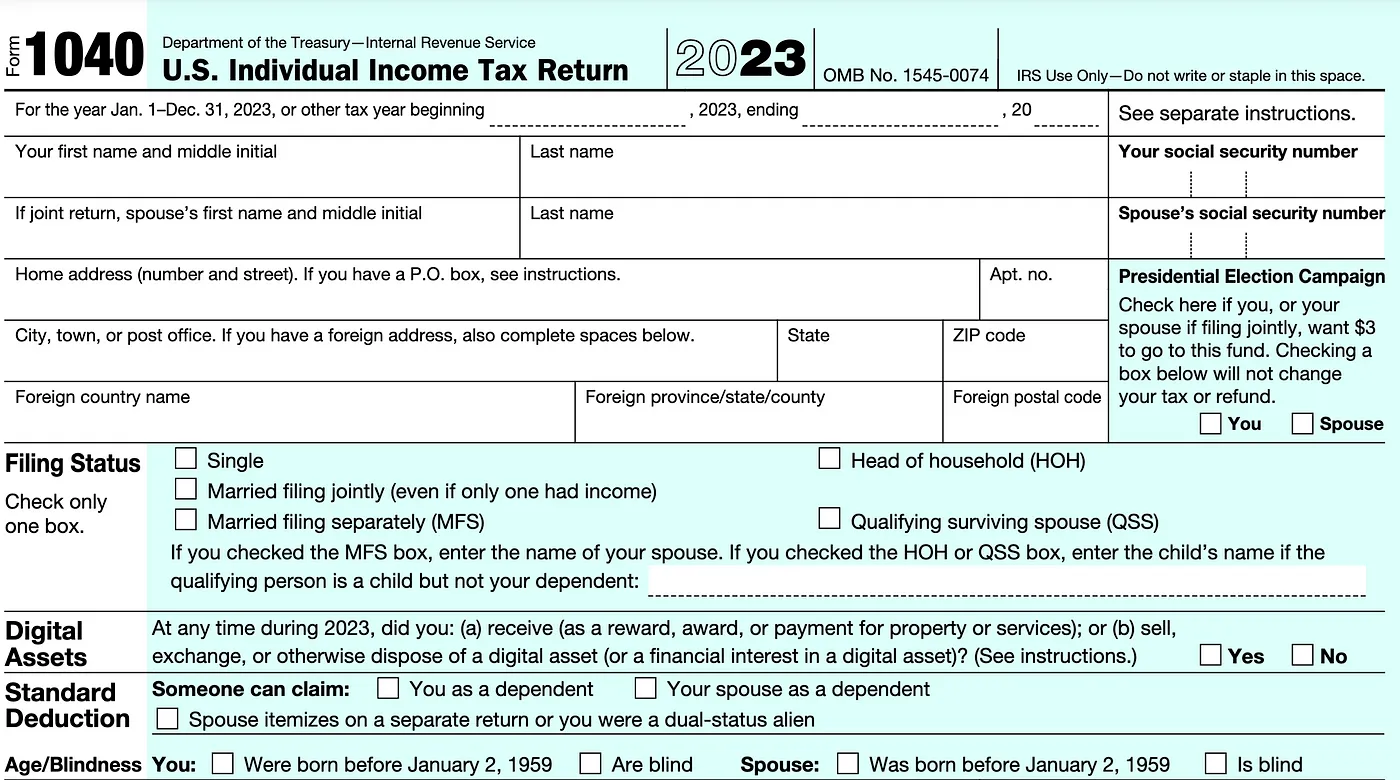

The IRS updates generally increased the inflation adjustment by about 10% beyond our CBO-based projections. For example, CBO projected that the standard deduction for single people would rise $350 from $14,600 in 2024 to $14,950 in 2025, while the IRS updated the value to $15,000. That $400 increase exceeded the $350 projection by 14%. Table 1 displays these

Table 1: IRS Updates for the Standard Deduction in Tax Year 2025

In addition to updating the standard deduction values, we also modified the values for the following provisions.

-

Additional earned income amount for the dependent standard deduction -

EITC joint bonus (difference between phase-out for single and joint filers)

We invite you to view all of the listed provisions above in our model and

david trimmer

Policy Research Fellow at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.