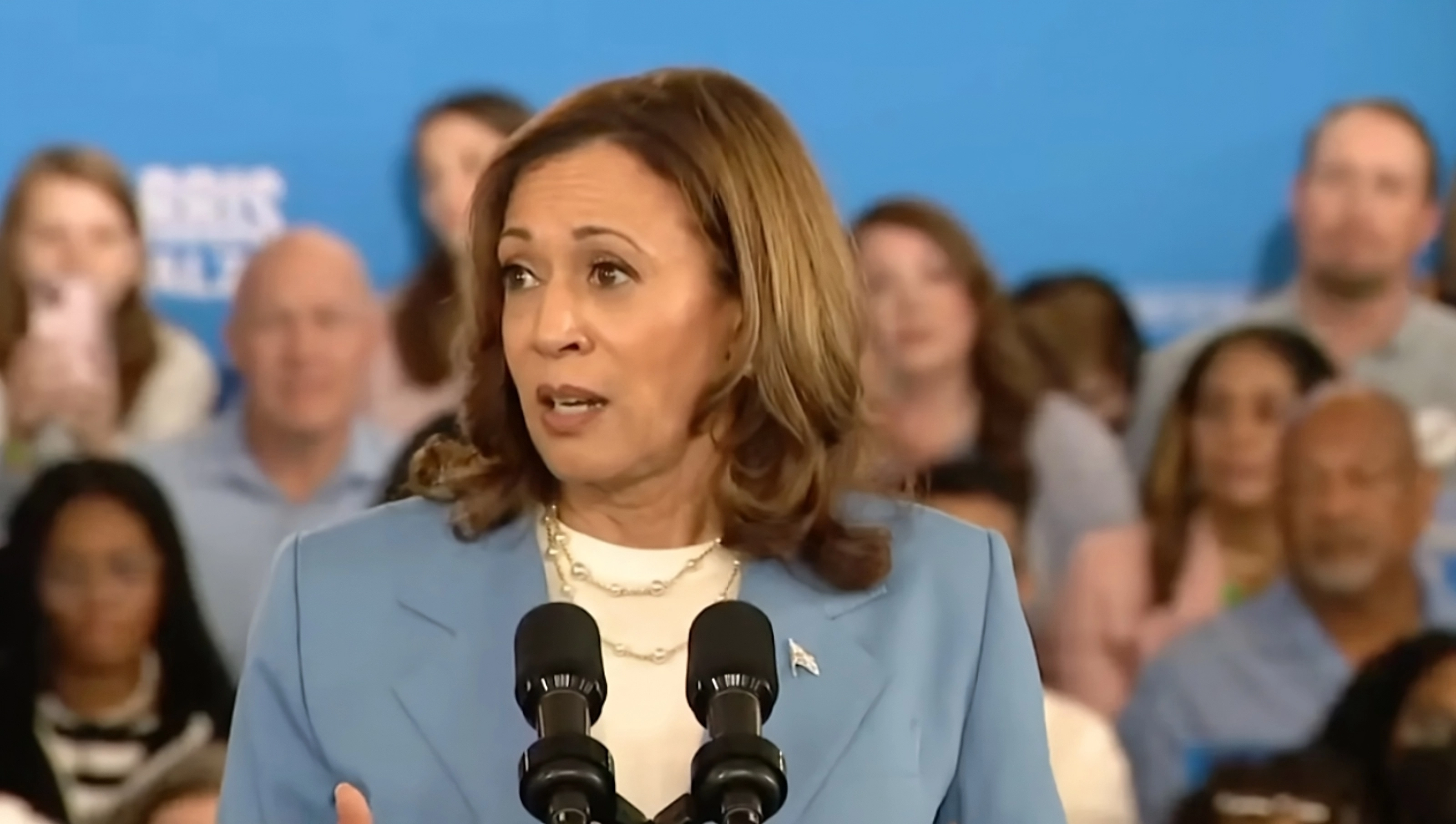

Kamala Harris’s Child Tax Credit Proposal

We analyze the Democratic nominee’s proposal to expand the 2021 expansion, giving $6,000 to parents of newborns.

Contents

The Child Tax Credit

The Harris Plan

Household Impacts

Microsimulation Results

Labor Supply Effects

Conclusion

The Kamala Harris campaign yesterday released an

Using the PolicyEngine model, we estimate that this Child Tax Credit expansion would have these effects in 2025:

-

Cost $117 billion

-

Benefit 44% of the population

-

Cut child poverty 31%

-

Lower the Gini index of income inequality by 1.4%

While these effects assume no behavioral responses, the projected cost rises about five percent when applying elasticities from the Congressional Budget Office.

The Child Tax Credit#

The Child Tax Credit (CTC) currently provides up to $2,000 per child, with a partially refundable structure; that is, filers without tax liability can claim only part of the credit — currently, $1,700. Low-income parents who don’t benefit from the full non-refundable credit can receive the Additional Child Tax Credit, which phases in with earnings above $2,500. The credit begins to phase out at incomes of $200,000 for single parents (head of household filers) and $400,000 for joint filers.

In 2021, the American Rescue Plan Act (ARPA) temporarily expanded the CTC, increasing the maximum credit to $3,600 for children under 6 and $3,000 for older children, making it fully refundable, and introducing an additional phase-out for higher-income households. We’ve previously analyzed the impacts of the

The Harris Plan#

Kamala Harris has now proposed not only restoring the ARPA expansion but also adding a “baby bonus” of $2,400 for children in their first year of life, bringing the total credit to $6,000 for newborns. While she has not yet detailed the baby bonus mechanism, we assume it follows the

Household Impacts#

Consider a parent, or parents, with no earnings who bear a newborn. Under current law, they would receive no Child Tax Credit, since they have no tax liability for the non-refundable $2,000 credit to count against, nor do they have the earnings for the Additional Child Tax Credit (refundable component) to phase in with. Under Harris’s proposal, they would receive the full $6,000 baby bonus, adding $6,000 to their net income.

As this household’s earnings rise, the net benefit falls: while they receive $6,000 under Harris’ plan, the difference is less as they would be entitled to more of a credit under current law. While Harris hasn’t specified the “middle-income and low-income families” who would be eligible, we assume the additional credit phases out with the rest of the ARPA CTC, as House Democrats designed the 2023 American Family Act to do.

Broadening the picture, we can view how this household and others with one child would benefit, depending on their marital status and the child’s age.

The maximum benefit varies with the child’s age: $6,000 for newborns, $3,600 for children age one to five, and $3,000 for children ages 6 to 17. Since 17-year-olds are ineligible under current law, they see a larger benefit. Married parents benefit more in some earnings ranges for two reasons:

-

Their higher standard deduction reduces their tax liability under current law, which requires them to have higher earnings to benefit from the non-refundable CTC

-

The Harris CTC expansion phases out at a higher income level for married filers compared to single (head of household) filers

Microsimulation Results#

Using PolicyEngine’s US microsimulation model version 1.54.3 and Enhanced Current Population Survey data, we estimate that Harris’ Child Tax Credit expansion would cost

The reform would

Harris Child Tax Credit Impact by Income Decile

Assuming full take-up, the proposal would reduce the Supplemental Poverty Measure 9.1% overall, with disproportionate impact for children (30.5%), Black and Hispanic Americans (10.6% and 11.4%), and women (9.7%). It would also reduce deep poverty 9.9%, including 36.3% among children. Finally, Harris’ CTC would reduce

Labor Supply Effects#

Incorporating labor supply responses based on Congressional Budget Office elasticities modifies these projections:

-

Hours worked would fall by

0.25% -

Earnings would fall by

0.14% -

The total federal cost would increase 4.8% to

$122.9 billion (state and local income tax revenue would also fall $0.9 billion) -

The child poverty impact would fall 6% (1.7pp) to

28.8%

About one-third of these changes reflect the “income effect” (people working less because they have more money), while two-thirds reflect “substitution effects” (changes in work incentives due to altered marginal tax rates).

Conclusion#

Based on the PolicyEngine model analysis, the proposed Child Tax Credit expansion by Kamala Harris is projected to cost $117.4 billion while reducing child poverty 31% without assuming behavioral responses, which would raise the cost 5% and lower the child poverty impact 6%. These projections are based on current economic conditions and assume full implementation and take-up of the proposed policy. Actual outcomes may vary based on economic fluctuations, implementation details, and other policy interactions.

We invite you to use our tools to explore the reform in more detail at the

max ghenis

PolicyEngine's Co-founder and CEO

pavel makarchuk

Economist at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.