Kamala Harris's LIFT Act Middle Class Tax Credit

A comprehensive analysis of the Vice President's 2018 proposal.

Contents

As a US Senator in 2018, Vice President Kamala Harris introduced the

What is the LIFT Act?#

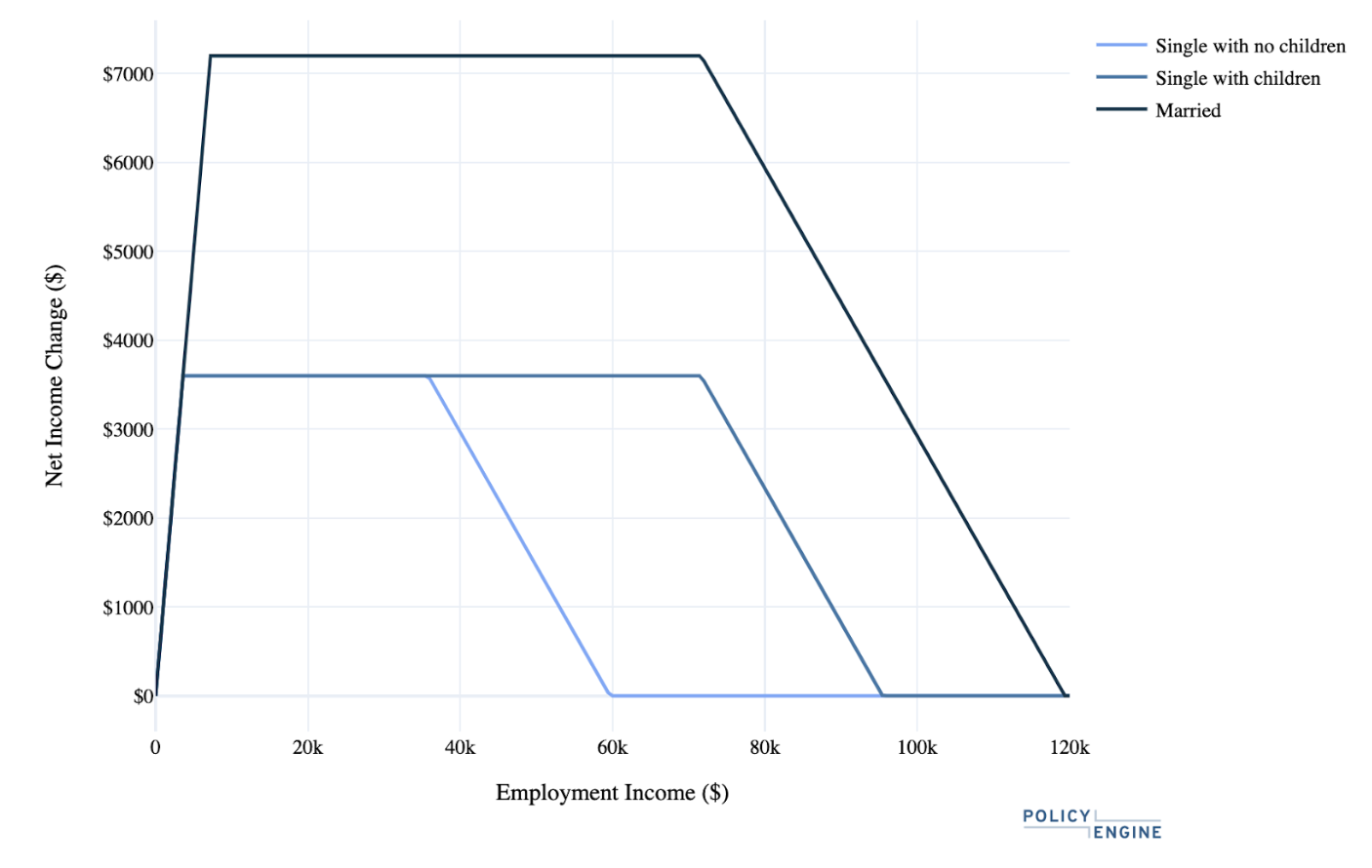

The LIFT Act's Middle Class Tax Credit phases in with 100% of earnings up to a maximum amount, then phases out with adjusted gross income over a window. Harris established it with inflation-indexed values in 2019, which creates the following structure in 2024:

Table 1: LIFT Act Middle Class Tax Credit parameters (2024)

This structure is depicted below. You can also calculate how the LIFT Act would affect your own household with

Figure 1: LIFT Act Middle Class Tax Credit by filing status and earnings level (2024)

Static US Impact#

- Cost $411 billion

- Lower poverty by 25.4%, with larger reductions for children, Blacks, Hispanics, and men

- Reduce the Gini index of income inequality by 4.1%

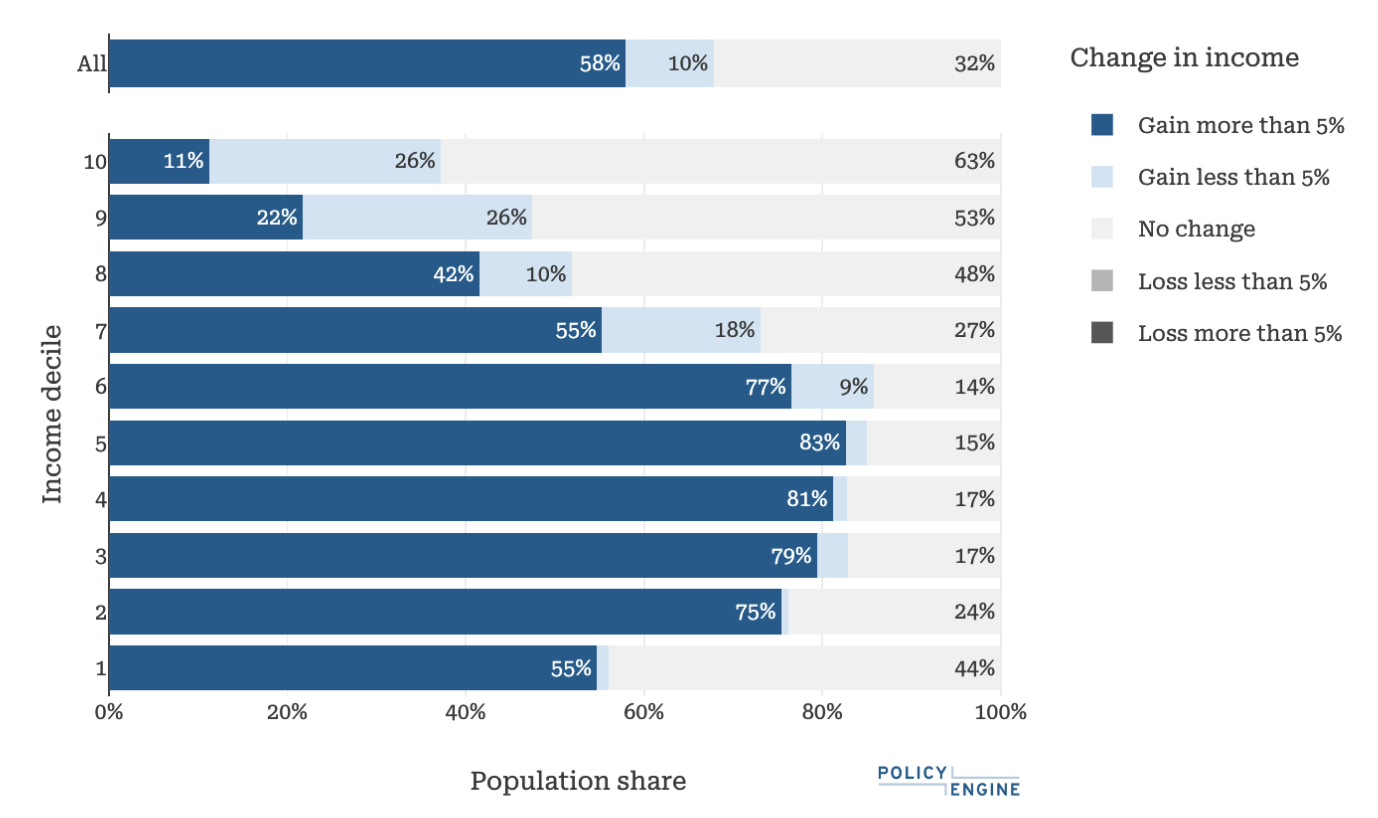

- Benefit 68% of Americans

Figure 2: Winners from the LIFT Act Middle Class Tax Credit by Decile (2024)

While the earnings requirement reduces the share of individuals in the bottom decile who would benefit, those in the second through sixth deciles gain more than those in higher income households.

US Impact Considering Behavioral Responses#

PolicyEngine now supports behavioral responses: users can enter their own income and substitution elasticities, which govern how people work less when they have more income and are paid less on the margin, respectively. The MCTC would be expected to reduce work through the income effect, and both increase and reduce work through the substitution effect, as it reduces marginal tax rates by 100 percentage points in the phase-in and increases them by 15 percentage points in the phase-out.

Applying elasticities from the Congressional Budget Office, we project that the MCTC would

Conclusion#

The LIFT Act proposed by then-Senator Kamala Harris includes a Middle Class Tax Credit that would reduce poverty and inequality through over $400 billion in annual transfers if fully taken up. This exceeds contemporaneous cost estimates (see Table 2), likely due to faster than expected inflation since 2018, which mechanically expands the nominal cost of the program through higher maximums and phase-outs. We also assume full take-up, which increases the costs compared to, for example, the Tax Policy Center's assumption of partial take-up.

Table 2: Comparison of LIFT Act Middle Class Tax Credit cost and poverty estimates

Incorporating behavioral responses adds about 10% to the cost, due to about 1% less labor supply. This results from income effects and substitution effects for those in the phase-out range, though some low-income earners would be projected to work more due to substitution effects.

As Vice President Harris pursues her 2024 presidential campaign, she may balance her prior proposals like the LIFT Act with newer policies in

max ghenis

PolicyEngine's Co-founder and CEO

pavel makarchuk

Economist at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.