Analysis of the Working Families Tax Cut Act

How the proposal to increase the standard deduction would affect households and society.

Contents

Household impacts

Budgetary impact

Distributional impact

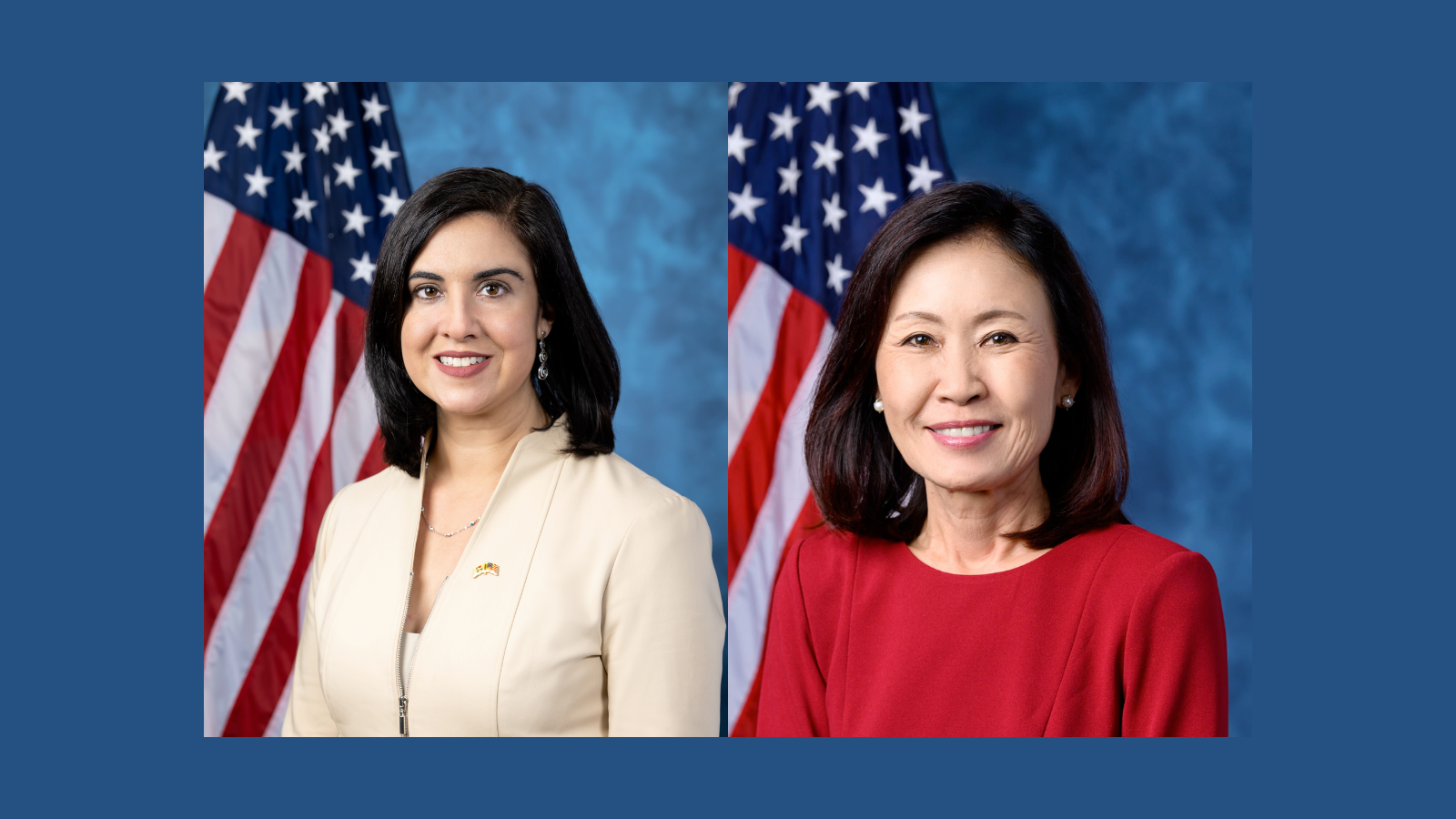

On Tuesday, Representatives Nicole Malliotakis (R-NY-11) and Michelle Steel (R-CA-45) introduced the

The standard deduction (which the

The bill reduces this additional standard deduction by 5% of adjusted gross income exceeding:

-

$200,000 for single and separate filers

-

$300,000 for head of household filers

-

$400,000 for married and widowed filers

Household impacts#

Consider a

The WFTCA would reduce the filer’s marginal tax rates by up to -10% in specific earnings ranges, around $15,000 and $60,000. The phase-out then raises

The WFTCA would affect other filers differently, depending on the marital status, children, and itemized deductions like charitable contributions.

Budgetary impact#

We project that the WFTCA would cost

Both TPC and AEI use the IRS public use file (PUF) rather than the Current Population Survey March Supplement (CPS), as PolicyEngine does. They also project the microdata into future years, while we use the 2021 CPS as-is, overwriting taxes and benefits with 2023 policy rules. We will

In New York and California, the states the authors represent, the bill would reduce tax liabilities by

Distributional impact#

On average, the proposal would raise net incomes by

On a

We estimate that the WFTCA would benefit

The WFTCA would

The proposal would

As a result of lowering marginal tax rates for low-income households, the WFTCA would

max ghenis

PolicyEngine's Co-founder and CEO

nikhil woodruff

PolicyEngine's Co-founder and CTO

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.