Massachusetts Governor Maura Healey's FY 2024 Budget Recommendation

PolicyEngine estimates the distributional impact of two provisions and the household impact of four provisions.

Contents

Governor Healey’s Budget Recommendation

Child & Family Credit

Estate tax

Renter tax deduction increase

Senior Circuit Breaker Credit increase

Short-term capital gains cut

Household examples

Family of five with childcare expenses

Single renter with short-term capital gains

Senior homeowning couple

Impact on Massachusetts

Budget

Distributional impact

Conclusion

On Monday, Massachusetts Governor Maura Healey introduced her

-

Replacing the existing dependent and dependent care credits with a Child & Family Credit of $600 per qualifying dependent

-

Reducing estate taxes

-

Increasing the cap on the renter’s tax deduction from $3,000 to $4,000

-

Doubling the maximum Senior Circuit Breaker Credit

-

Reducing the rate on short term capital gains from 12% to 5%

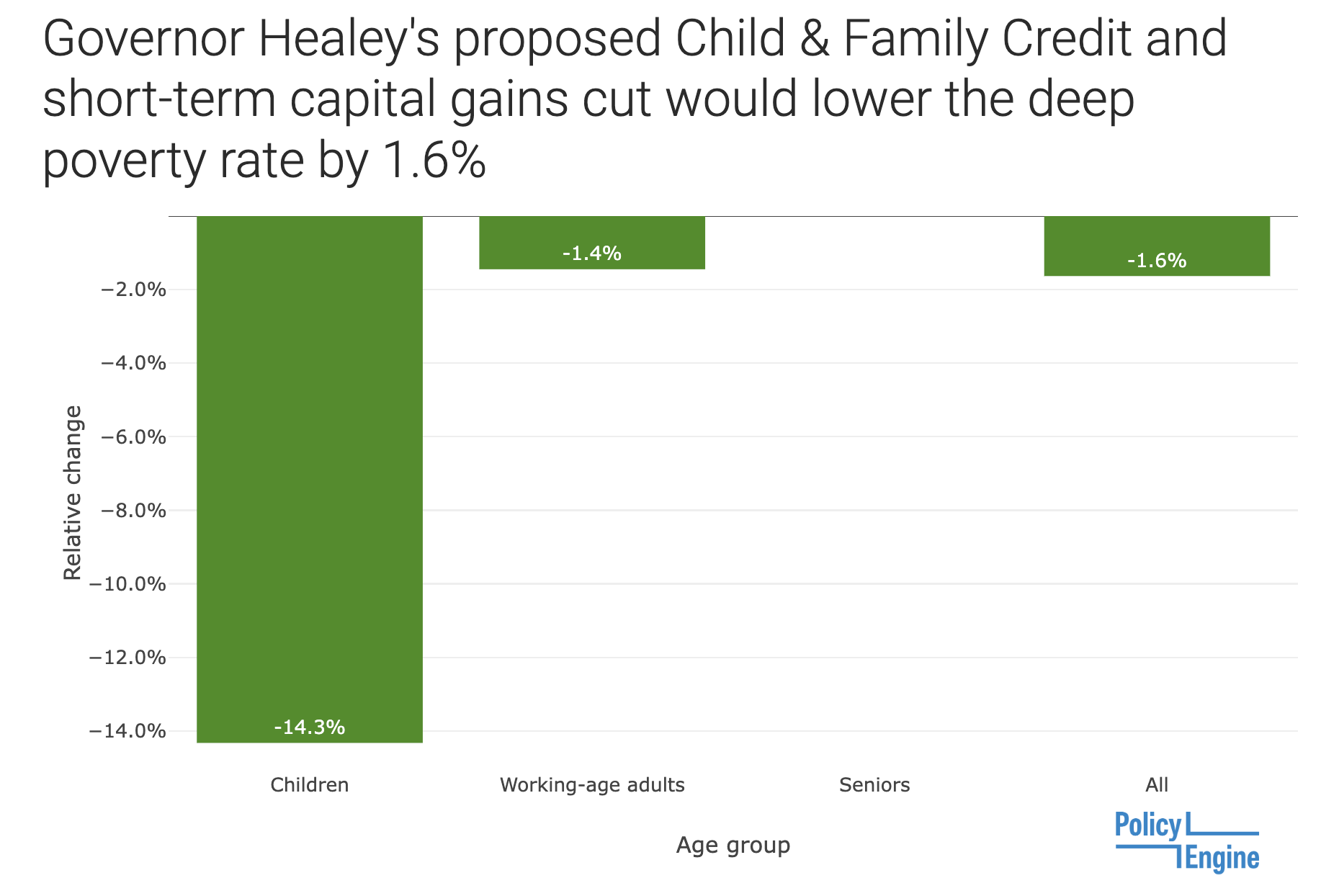

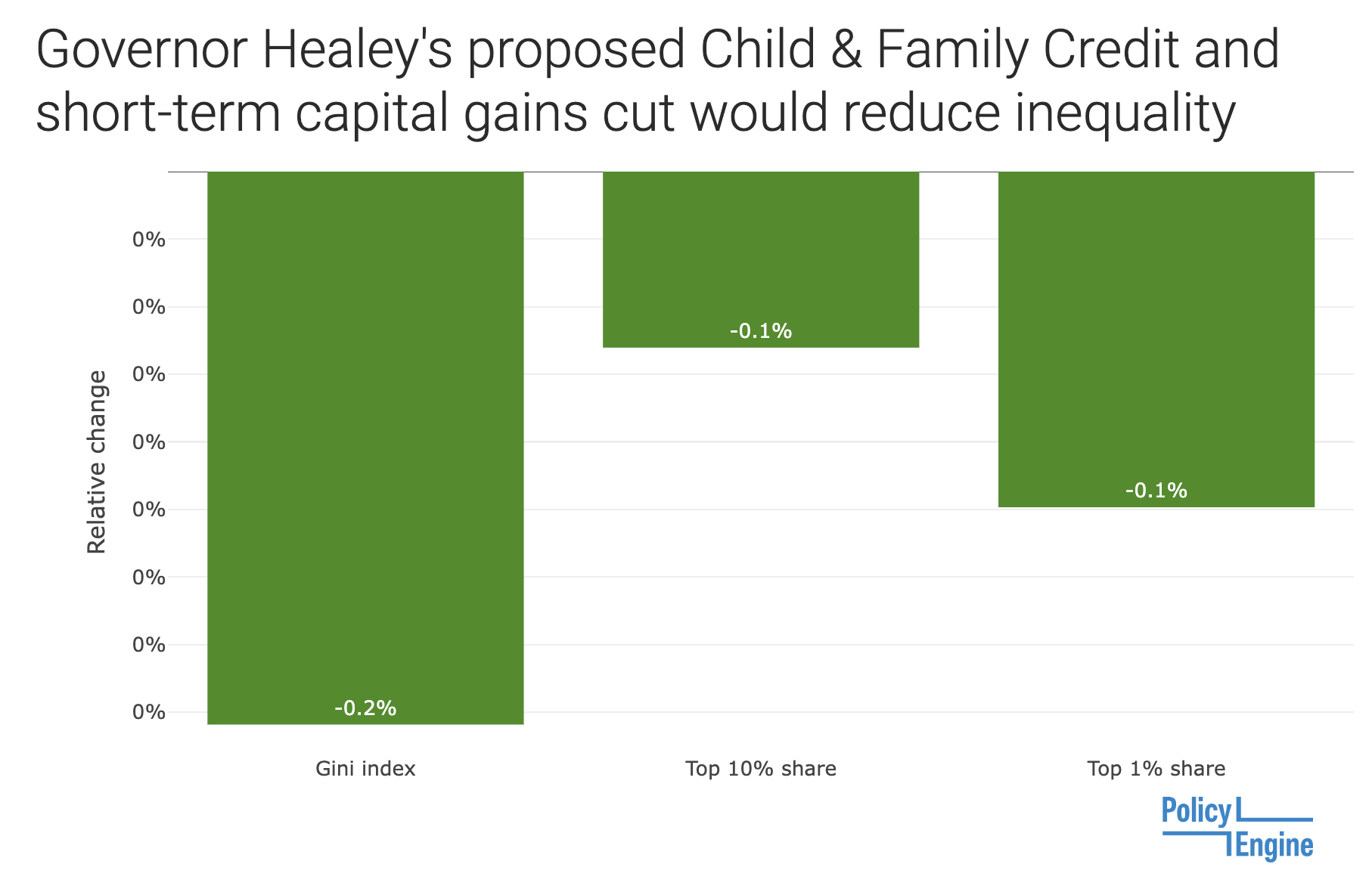

PolicyEngine models the personal income tax code of Massachusetts, including each of the provisions Healey seeks to modify, except the estate tax. Our microsimulation model also supports population-wide impacts of two of the provisions: the Child & Family Credit and the capital gains reform. PolicyEngine estimates that these two provisions would together benefit 38% of the Massachusetts population and reduce the Gini index of income inequality by 0.2%. Our cost projections fall 15% below the state’s, though we can attribute at least some of this divergence to inaccuracies in the Census Bureau’s Current Population Survey.

This post describes these provisions, examines the impact on three hypothetical households, and shows our microsimulation model’s distributional impacts for the available provisions.

Governor Healey’s Budget Recommendation#

Here we detail each provision.

Child & Family Credit#

Currently, Massachusetts families can claim one of the following two refundable tax credits:

-

Dependent Tax Credit, which provides $180 to children up to age 11

-

Dependent Care Tax Credit, which provides up to $240 per child, also up to two children, up to age 12 and phasing in with the lesser of the filer head and spouse’s earnings (similar to the federal Child and Dependent Care Credit)

Estate tax#

Governor Healey proposes eliminating any Estate Taxes for estates with a value of less than $3,000,000 and providing a non-refundable Estate Tax credit of up to $182,000 for estates valued above $3,000,000. PolicyEngine does not model estate taxes.

Renter tax deduction increase#

Massachusetts provides a tax deduction of up to 50% of filers’ yearly rent, capped at $3,000. Governor Healey proposes raising this to $4,000.

Senior Circuit Breaker Credit increase#

Massachusetts provides a Senior Circuit Breaker Tax Credit, which reduces tax liabilities for filers aged 65 or older, depending on their income, rent, and property tax, in particular when rent and property tax exceed 10% of one’s income. Governor Healey proposes doubling the maximum credit from $1,200 to $2,400.

Short-term capital gains cut#

Massachusetts currently taxes most income at 5%, except income exceeding $1 million (9%) and short term capital gains (12%). The federal government and two other states also tax capital gains differently depending on whether the assets have been held for a year. Governor Healey proposes equalizing short and long term capital gains rates by reducing the short term rate from 12% to 5%.

Household examples#

To illustrate the impact of the four policies, we show how they would affect three hypothetical households: a family of four with childcare expenses, single renter with short-term capital gains, and senior homeowning couple. In each case, we show the impact to net income and marginal tax rates as the household head’s earnings vary.

Family of five with childcare expenses#

Consider this family of five:

-

Spouse earns $20,000 per year, one infant, one six-year-old child, and one ten-year-old child

-

Renting in Norfolk County, and paying

$3,600 per month , Zillow’s estimated median for three-bedroom homes in Massachusetts -

Paying the median center-based infant care cost in Norfolk County, which the

US Department of Labor estimates at $26,409 per year in 2022 (the highest in Massachusetts) -

No childcare costs for the six- and ten-year-old children

Governor Healey’s proposal would

Overall, this family would benefit mainly from the consolidation of the Dependent Credit and the Dependent Care Credit into the Family & Child Tax Credit. Current law entitles them to a maximum credit of $240 per child, up to a max of two children, giving them $480. Governor Healey’s proposal would make three of their children eligible for a $600 credit,

Single renter with short-term capital gains#

Consider a single person paying $2,050 per month in rent,

Governor Healey’s proposal would

The reform

Senior homeowning couple#

Finally, consider a couple, each 70 years old and owning a home.

Each receives $21,348 per year in Social Security retirement benefits, the average according to the

Their home is worth $545,865,

Governor Healey’s proposal would

This is the income range over which the reform raises the Senior Circuit Breaker Credit.

The reform increases the filer’s marginal tax rate by ten percentage points in this phase-out range.

Impact on Massachusetts#

PolicyEngine’s microsimulation model pairs our tax-benefit rules engine with the Current Population Survey to estimate the aggregate impact of policy reforms. As the CPS does not contain information about households’ rent, property taxes, or inheritance, we estimate only the impact of the Child & Family Credit and the capital gains reform.

Budget#

Compared to the Finance Director’s report, PolicyEngine projects lower costs of each provision: 11% lower for the Child & Family Credit and 35% lower for the capital gains cut. We will release a

Distributional impact#

Together, the two provisions PolicyEngine models population impacts for — the Child & Family Credit and the short-term capital gains cut — would

These provisions would

PolicyEngine projects

PolicyEngine’s poverty impacts in small states are noisy, due to using a single year’s Current Population Survey.

The two provisions would

While the reforms alter marginal tax rates, we do not project any

Conclusion#

Governor Healey’s FY 2024 Budget Recommendation proposes several significant policy changes that would impact households in Massachusetts in diverse ways. PolicyEngine’s microsimulation model provides valuable insight into the potential impact of these proposals on different segments of the population. While further analysis may be required to fully understand the impact of these policies on the residents of Massachusetts, PolicyEngine’s ability to enable detailed analysis of policies is a valuable tool for policymakers in designing and evaluating policy proposals. As Massachusetts moves forward with its budget process, PolicyEngine’s analysis can provide valuable information to policymakers and support evidence-based decision-making.

max ghenis

PolicyEngine's Co-founder and CEO

nicholas rodelo

Researcher at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.