Individual Income Tax Provisions in Minnesota Bill HF1938 (2023)

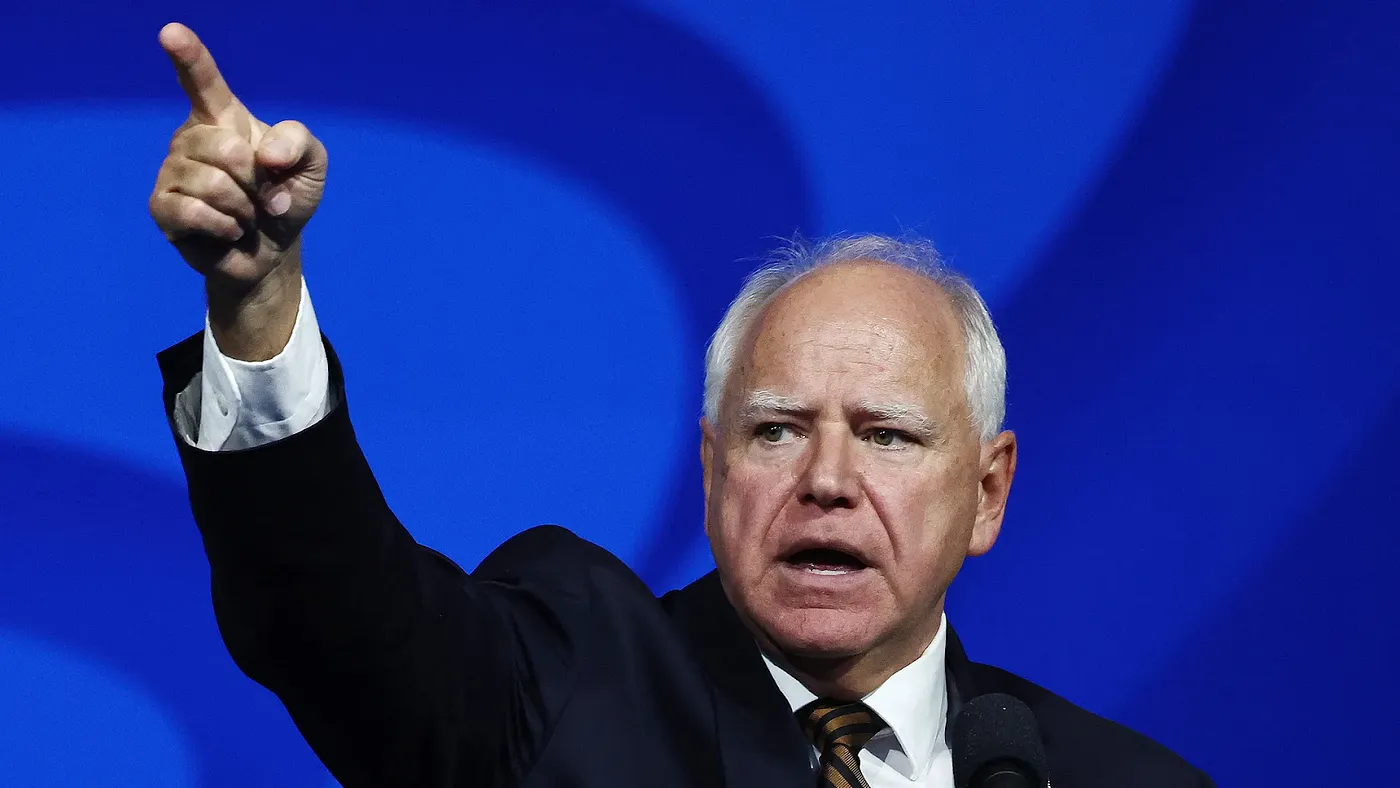

The reform signed by Governor Tim Walz expanded credits for low-income families, reduced taxes for middle-income retirees, and raised taxes for high-income filers.

Contents

Working Families Tax Credit

Introduces Retirement Benefits Subtraction for Public Sector Pensions

Expands Social Security Subtraction

Expands Child and Dependent Care Credit (CDCC)

Further Reduces Standard and Itemized Deductions for High Income Filers

Child and Working Family Credit

Reduced Standard Deduction

Social Security and public pension subtractions

In March 2023, Minnesota Governor Tim Walz signed into law

PolicyEngine’s static microsimulation results for 2023 project that HF1938’s individual income tax provisions:

-

Cost $444 million

-

Reduced poverty by 2% and child poverty by 9%

-

Increased net income for 22% and reduced net income for 4% of Minnesotans

-

Lowered the Gini index of income inequality by 0.9%

This report describes provisions of HF1938, illustrates the impacts with hypothetical households, and summarizes projected Minnesota-wide impacts.

Provisions of HF1938#

HF1938 expanded low-income tax credits, adjusted retirement income subtractions, and reduced standard and itemized deductions for high-income filers. It also included several provisions PolicyEngine does not currently model, including property tax adjustments as well as education tax credit.

Working Families Tax Credit#

The new law introduces a combined Child and Working Family Tax Credit, replacing the previous Working Family Credit (which resembled the federal Earned Income Tax Credit) and adding a new child tax credit (CTC) component:

Introduces Retirement Benefits Subtraction for Public Sector Pensions#

-

Subtracts up to $12,500 ($25,000 married) in public sector pension benefits from state adjusted gross income

-

Phases out at 5% of income above $78,000 ($100,000 married)

Expands Social Security Subtraction#

-

Increased the maximum amount of Social Security benefits subtracted from state adjusted gross income from $4,020 to $4,560 ($5,150 to $5,840 married)

-

Increased reduction thresholds from $61,080 to $69,250 ($78,180 to $88,630 married)

-

Maintains $40,000 phase-out window (10% per $4,000 income above the threshold)

Expands Child and Dependent Care Credit (CDCC)#

- Made married filing separately filers eligible for the state CDCC

Further Reduces Standard and Itemized Deductions for High Income Filers#

- Adds two new reductions to standard and itemized deductions for high-income filers, atop the existing reduction equal to 3% of income above $110,325 ($220,650 married): 10% of income over $304,970 and 80% of income over $1,000,000

Household Impacts#

Child and Working Family Credit#

The new Child and Working Family Tax Credit provides up to $3,385 to eligible Minnesota households. For instance, a single parent with two children (ages 10 and 5) earning $30,000 now receives an additional

The following graph shows how the reform affects a married couple with two children as well as for a single parent:

Figure 1: Credit amount comparison of the Working Family Credit and the new Child and Working Family Credit on a couple and single parent of two (10 and 5) (2023)

Looking at the

Figure 2: Net income impact of the Minnesota Bill HF1938 on a single parent of two (10 and 5) with earnings up to $100k (2023)

The credit change also impacts

Figure 3: Marginal Tax Rate changes under the Minnesota Bill HF1938 on a single parent of two (10 and 5) (2023)

Reduced Standard Deduction#

Zooming out, we can see that the reform reduces

Figure 4: How Minnesota Bill HF1938 (2023) affects a joint filer’s standard deduction

Accordingly, the reform increases this household’s taxes by as much as $966, for earnings of $445,000.

Figure 5: Net income impact of the Minnesota Bill HF1938 on a single parent of two (10 and 5) with earnings up to $800k (2023)

Social Security and public pension subtractions#

To illustrate the changes to the subtractions for Social Security benefits public pensions, consider an individual receiving $25,000 in public pensions (for example, from teaching in public schools) and $20,000 in Social Security benefits. These are both roughly average values. This individual would pay up to $1,500 less in

Figure 6: Impact of the new subtraction structure under the Minnesota Bill HF1938 on a senior with $25k of public retirement income and $20k of social security retirement income (2023)

Microsimulation Results#

PolicyEngine’s US microsimulation model (version 1.57.1), run over the indexed 2022 Current Population Survey March Supplement for 2023, reveals several key impacts of HF1938’s individual income tax provisions:

-

Costs

$444 million -

Lowers Minnesota’s Supplemental Poverty Measure by 1.9%, including

9.4% for children and45.6% for deep child poverty -

Reduces income inequality in Minnesota: the Gini index falls

0.8% , while the net income share held by the top 1% and 10% each fall 0.2%

Figure 7: Winners and Losers from the Minnesota Bill HF1938 by Decile (2023)

These results assume no behavioral responses.

Conclusion#

The Minnesota tax reform bill HF1938 introduces changes to the state’s tax structure, particularly in areas of family tax credits, retirement benefits, and deductions for high-income earners.

The microsimulation results suggest that these reforms will reduce inequality and poverty, especially among children. The changes in tax credits and deductions create a mixed effect across income levels, with a majority of residents seeing increased after-tax income, while a smaller percentage, primarily in higher income brackets, experience reductions.

pavel makarchuk

Economist at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.