PolicyEngine Powers Niskanen Center's Analysis

Three new reports from the Niskanen Center think tank demonstrate PolicyEngine's tax and benefit reform model.

Contents

PolicyEngine recently powered three Niskanen Center tax and benefit reforms. Our updated model offers new opportunities to explore both the budgetary and distributional impacts of these proposals on childhood poverty. Niskanen, the first major American think tank to use PolicyEngine, follows in the footsteps of institutions such as The

The report, "

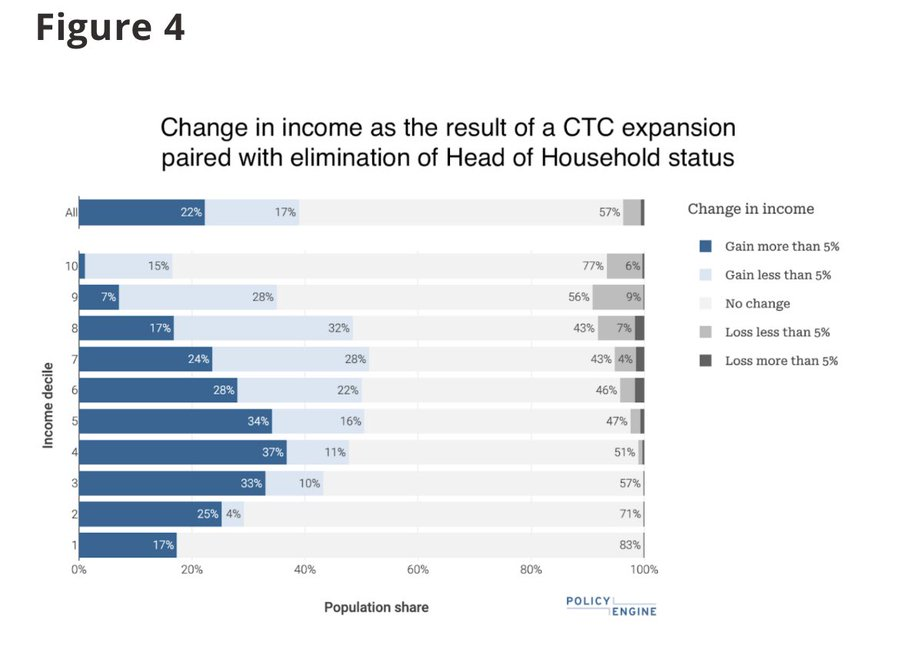

PolicyEngine's built-in instant interactive data visualizations powerfully illustrate the distributional effects of Niskanen's proposals across income deciles. For example, the chart below unpacks the distributional analysis of two simultaneous reforms–an expansion of the CTC combined with the elimination of the head of household (HoH) filing status, which reduces taxes for single parents compared to single individuals. Policy makers are often looking to find lower costs, and charts like these demonstrate how multivariate changes to the tax-code enable policymakers to balance budgetary concerns with impact. James Medlock, a favorite contributor to online policy discussion, applauded the chart: "Especially for more 'give and take' reforms like this, it's nice to show heterogeneity within deciles,"

PolicyEngine also empowers consumers of policy reforms to test the analysis and dig deeper. PolicyEngine's free open source model makes our assumptions transparent and enables anyone to design policy reforms. For example, by clicking

Two other recent Niskanen analyses demonstrate PolicyEngine's versatility. The first, on

As PolicyEngine grows and improves, institutions like the Niskanen Center can continue their thoughtful analysis in an ever more efficient, intuitive, and user-friendly way. Interested in using PolicyEngine for your own work? Reach out at

max ghenis

PolicyEngine's Co-founder and CEO

ben gross

Communications Intern at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.