The Child Tax Credit in 2023

We review how the program works and compute its impact with PolicyEngine US.

Contents

What is the Child Tax Credit?

How does the Child Tax Credit affect individual households?

How does the Child Tax Credit impact society?

Credit: DALL-E 2

In Tuesday’s State of the Union speech, President Joe Biden called to expand the Child Tax Credit. What is the Child Tax Credit, how might it affect you, and what impact does PolicyEngine estimate it has on society? This blog post covers the bases.

What is the Child Tax Credit?#

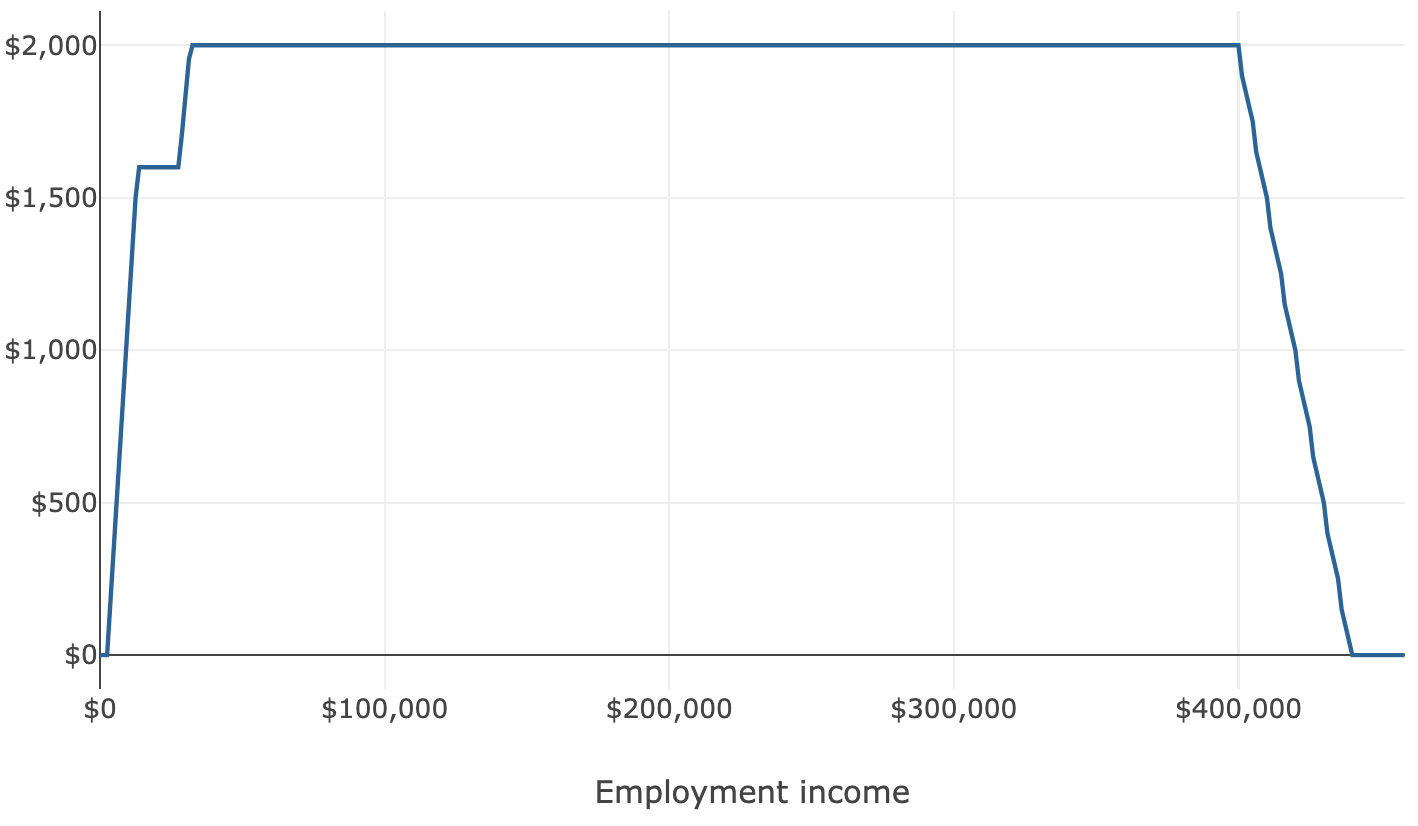

The Clinton administration introduced the Child Tax Credit (CTC) in 1997 as a partially refundable credit. That is, some tax filers, including those with no federal tax liability, could claim a portion of the credit. The refundable portion of the credit, known as the Additional Child Tax Credit, phased in with income. The full credit value reduced tax liability towards zero, but higher-income earners phased out of the credit.

The 2017 Tax Cuts and Jobs Act expanded the CTC by:

-

Doubling the maximum credit amount to $2,000 per child

-

Increasing the refundable portion

-

Extending the phase-out threshold

-

Limiting the credit for children and dependents without Social Security numbers

The Joint Committee on Taxation

For the 2021 tax year only, the American Rescue Plan Act further expanded the CTC in several ways. ARPA:

-

Extended eligibility to 17-year-olds

-

Raised the maximum amount from $2,000 per child to $3,600 for children under age 6 and $3,000 for children aged 6 to 17; this higher amount is available to parents with income below $75,000 (single) or $150,000 (married)

-

Made the credit fully refundable

-

Prepaid half the expected 2021 credit on a monthly basis, beginning in July 2021

Other than ARPA, the CTC structure has not changed since 2018, aside from some parameters increasing with inflation (though the law fixes the maximum credit value at $2,000).

How does the Child Tax Credit affect individual households?#

We can compute the impact of the Child Tax Credit in PolicyEngine by first

Consider a

If we

Correspondingly, the

To see how the Child Tax Credit affects your own finances and work incentives,

How does the Child Tax Credit impact society?#

We can compute the impact of the Child Tax Credit in PolicyEngine by first abolishing the Child Tax Credit, and then swapping the baseline and reform. This tells us the impact of introducing the CTC compared to a baseline where it doesn’t exist. I showed how to design it below, but you can skip to the impact

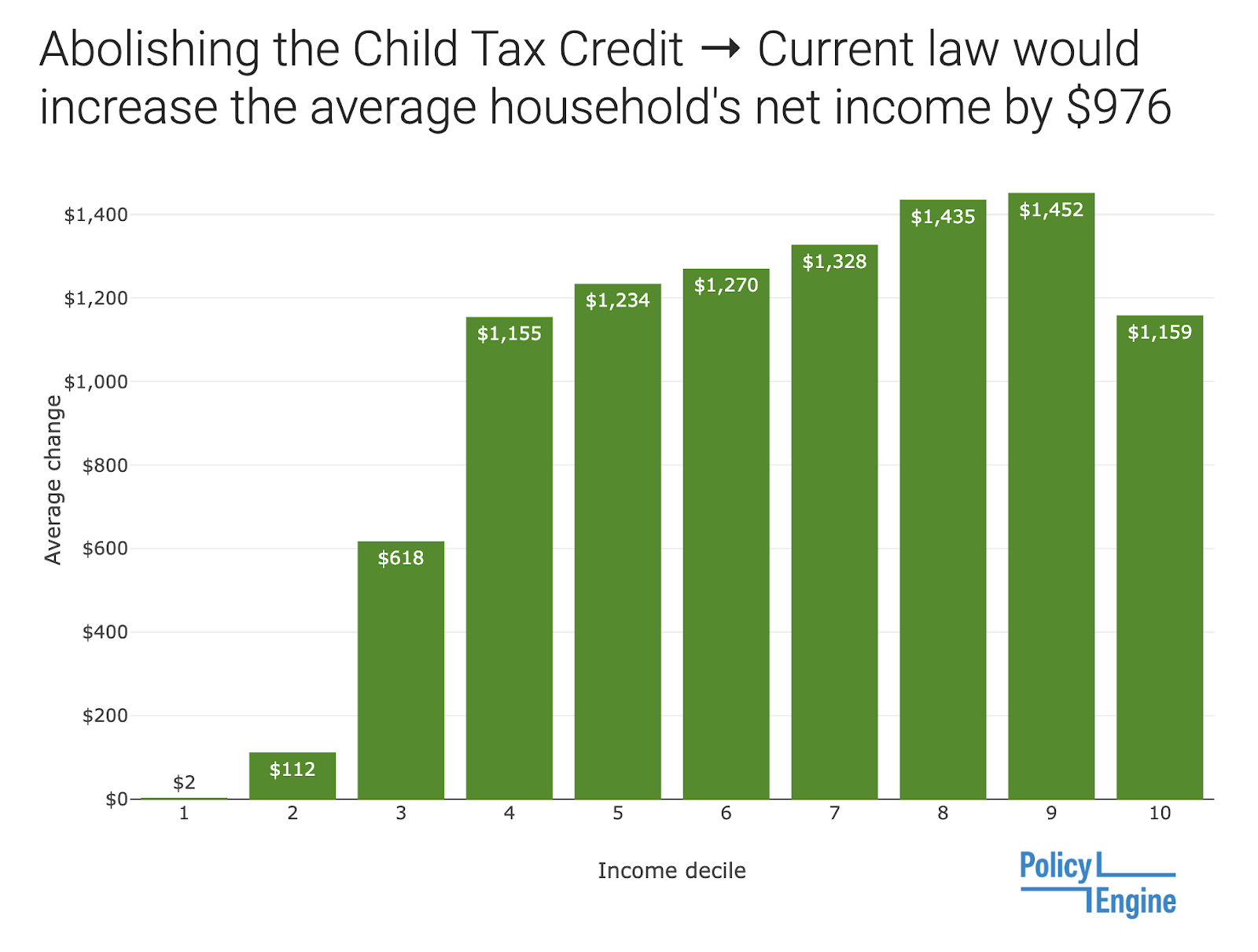

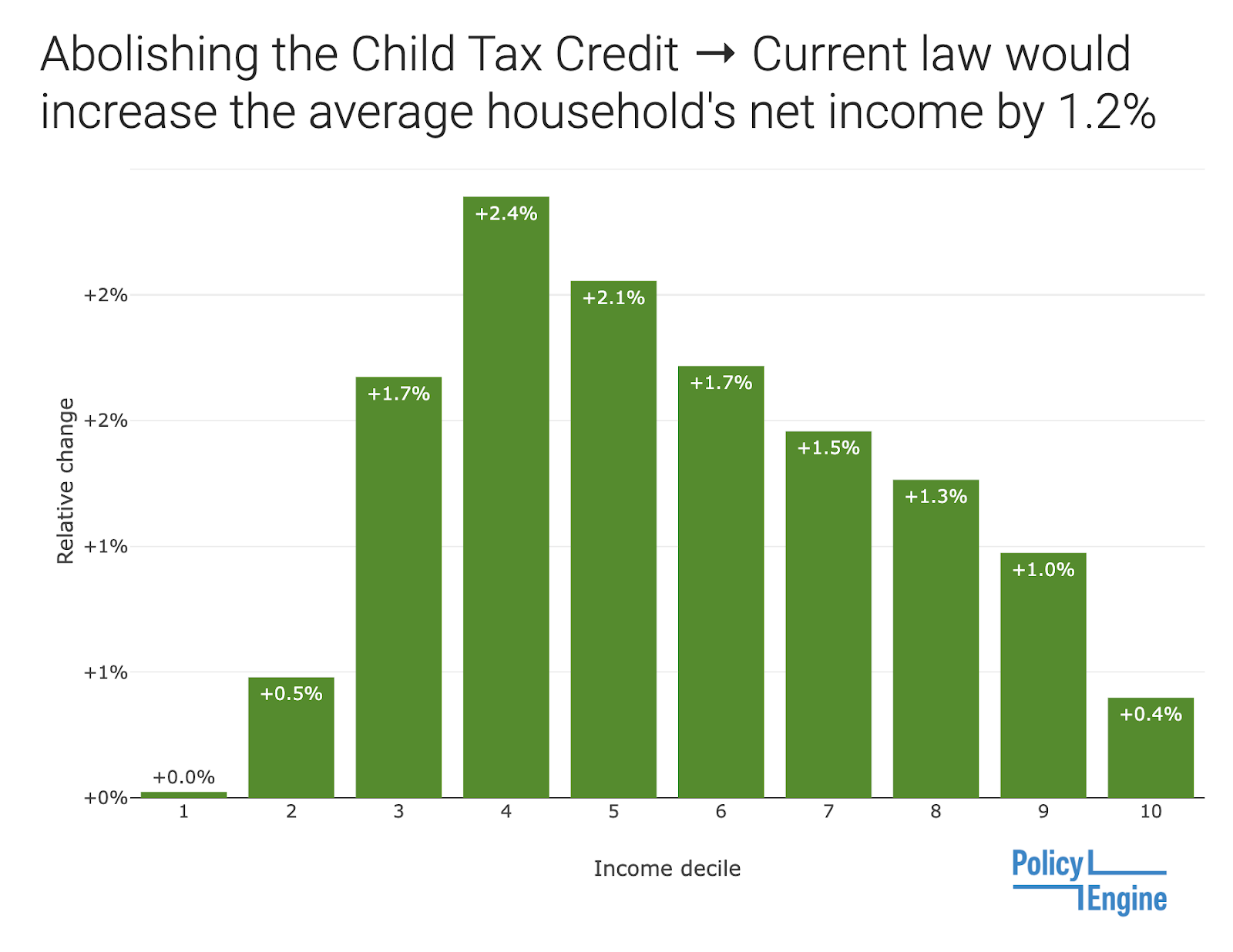

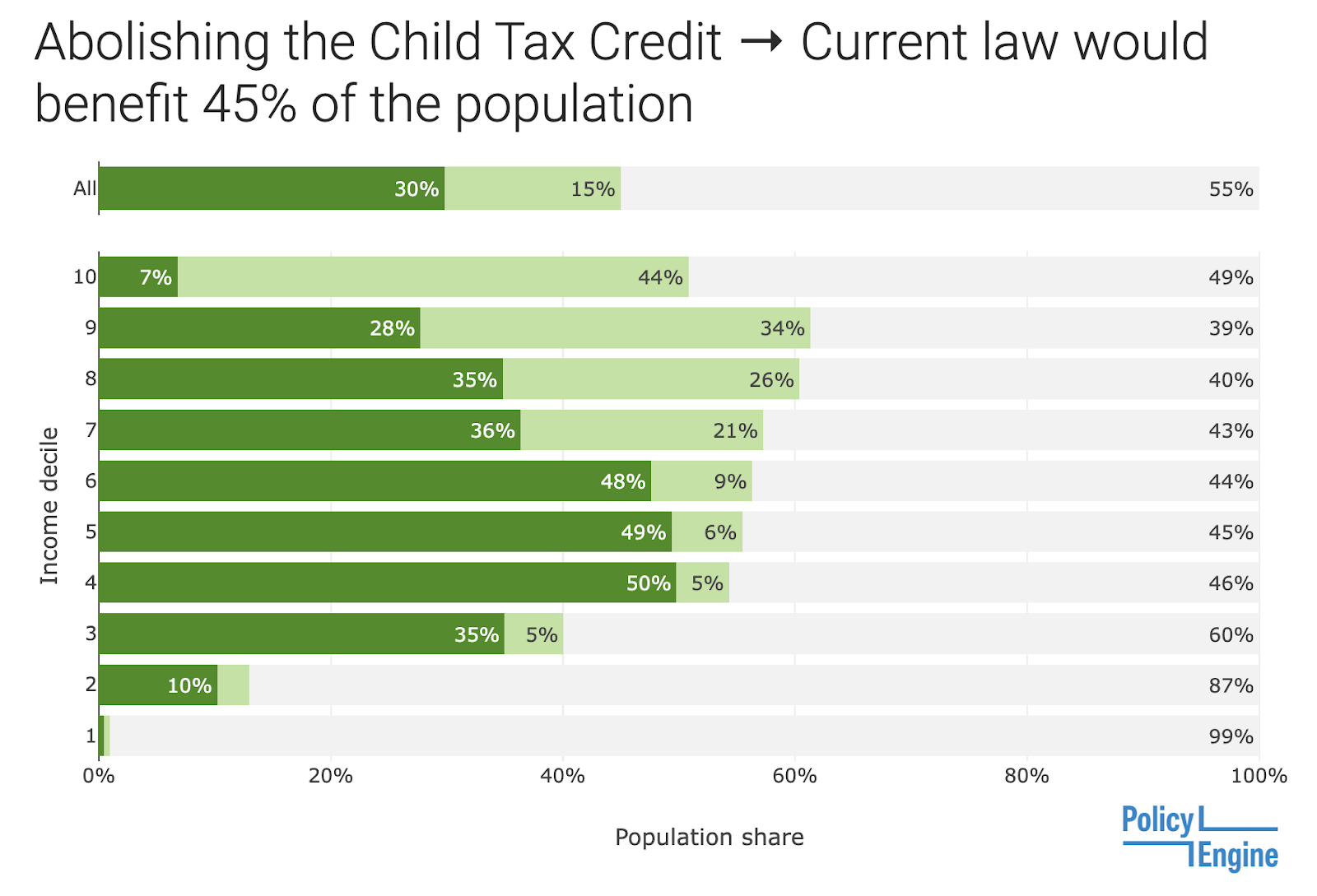

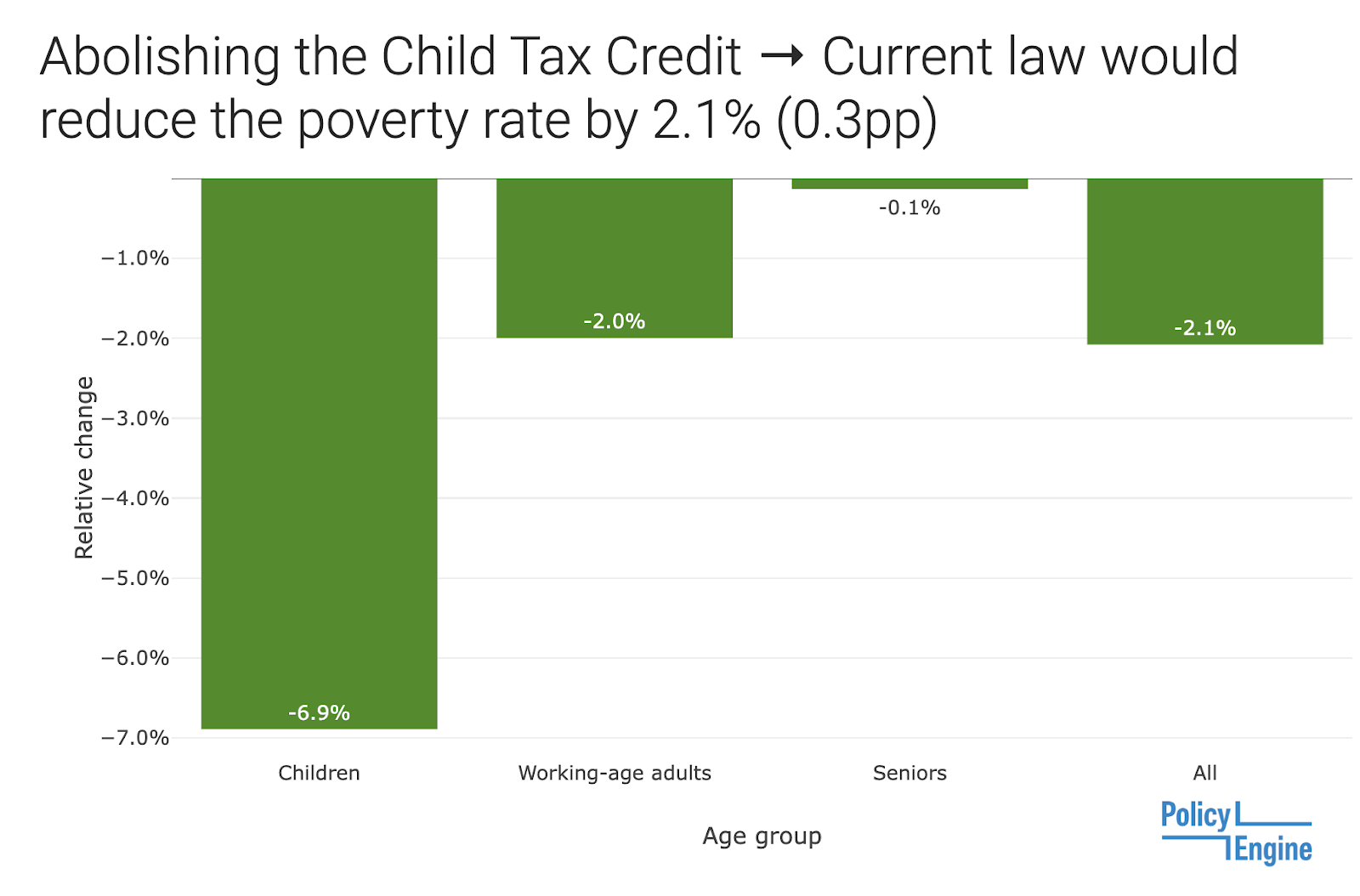

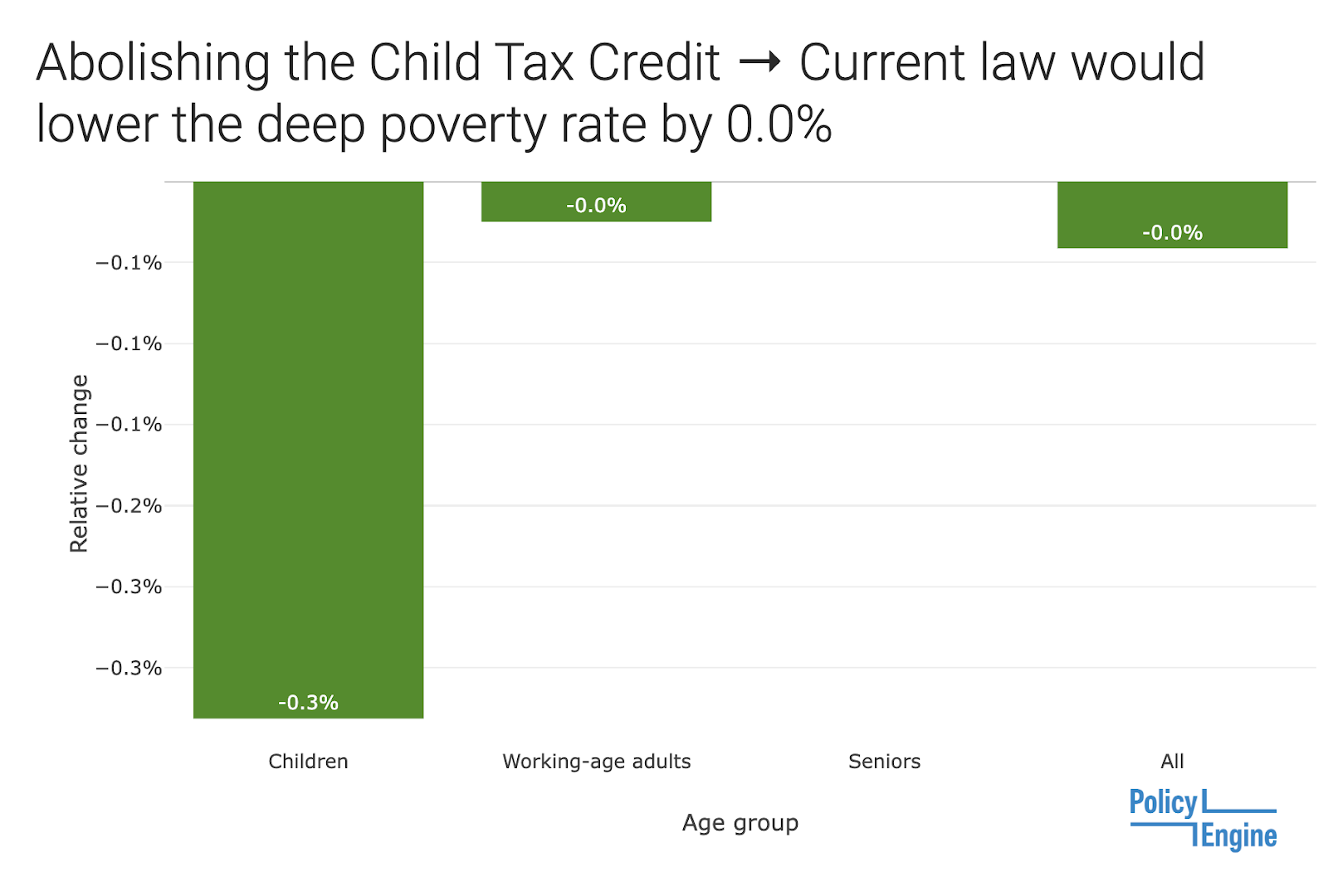

In 2023, we estimate that the

Among the bottom 90% of households, the

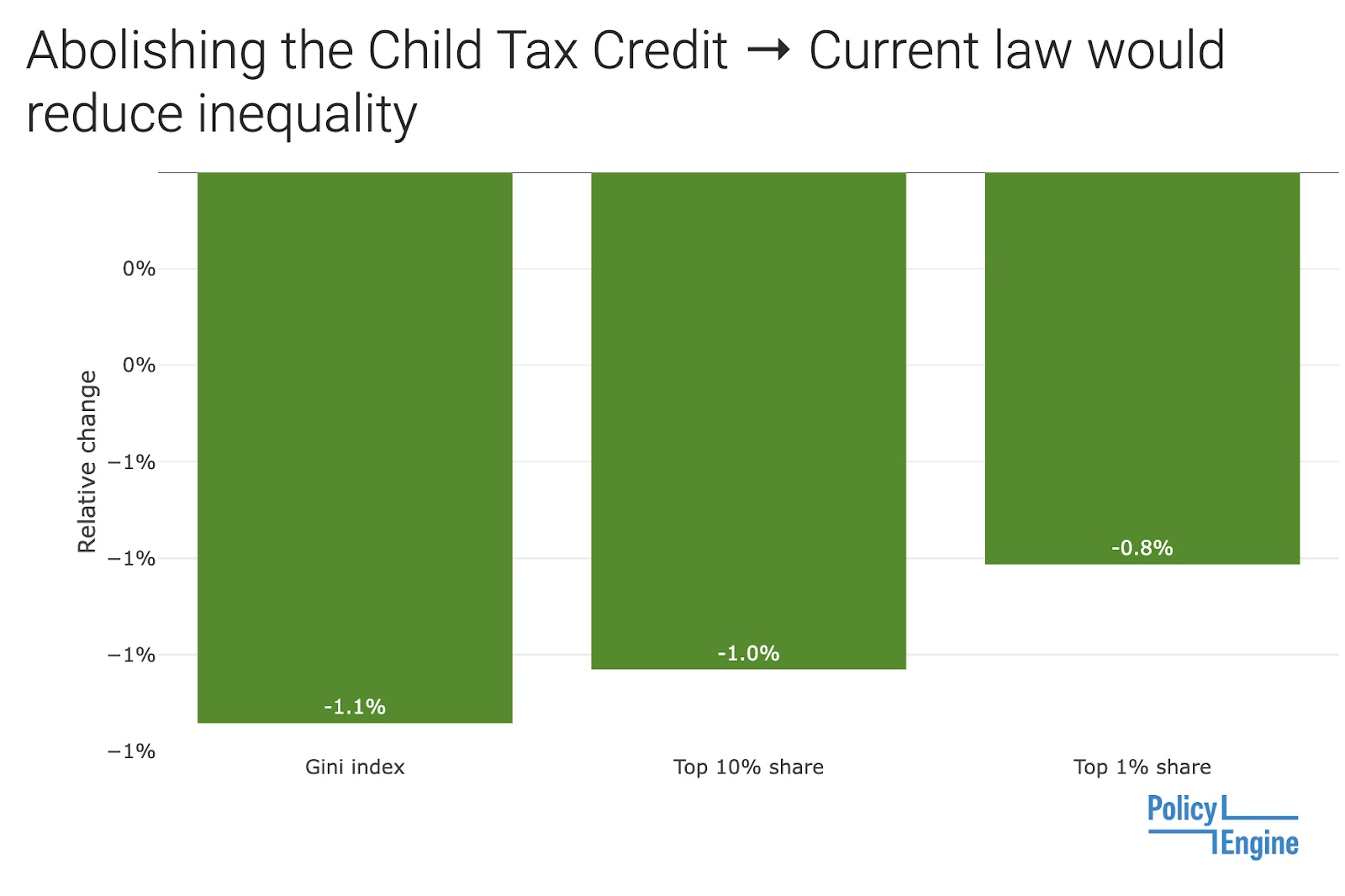

The

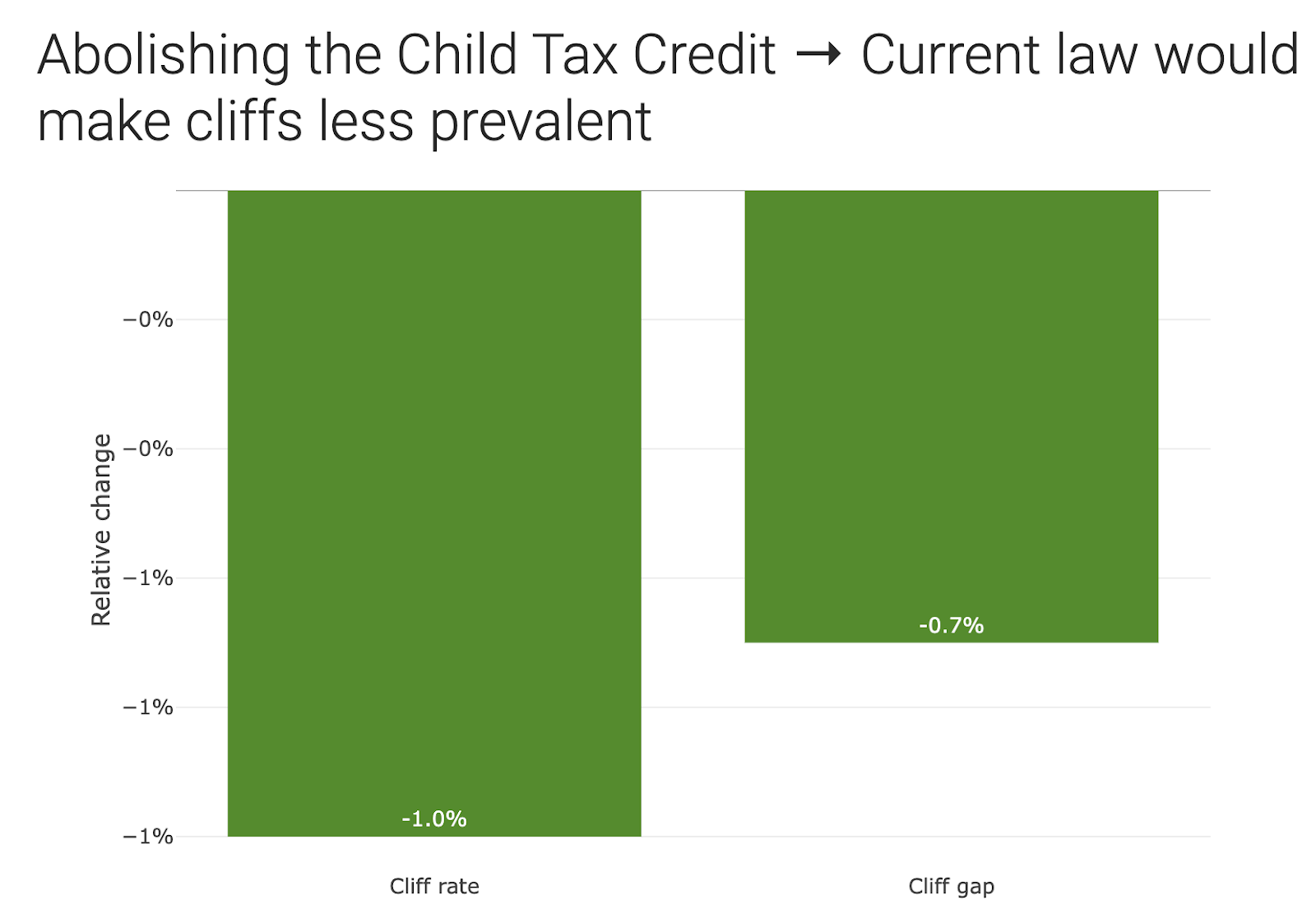

The

The

You can view these analytics for any US state using the drop-down menu in the right panel. For example, in Pennsylvania, the Child Tax Credit

In conclusion, PolicyEngine provides a variety of analytics on the Child Tax Credit (CTC). Individuals can navigate the partially-refundable structure to estimate how it affects them, and explore different earnings scenarios. Those interested in broader effects can view our estimates of the CTC’s cost and distributional impacts, such as the degree to which it reduces poverty, inequality, and cliffs across the US and individual states. As policymakers explore CTC reforms, and households continue to seek information on it, we will continue to provide personalized and

max ghenis

PolicyEngine's Co-founder and CEO

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.