The Conservative Manifesto

PolicyEngine's comprehensive impact score.

Contents

Key findings

Introduction

Spending

Taxes

Overall

Economic impact

Conclusion

Appendix

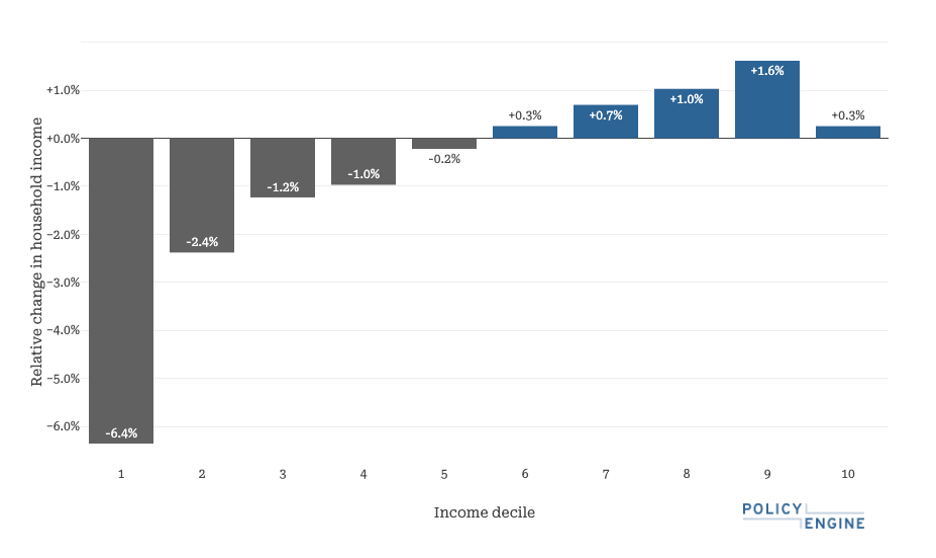

Distributional impact of the Conservative 2024 Manifesto. See the full impact score

Key findings#

-

The Conservatives propose a plan which we estimate will increase spending by £5.8bn over the next five years.

-

The spending reform will include increases in education expenditures and NHS funding, while decreasing other public spending, raising a total of £43.9bn.

-

Tax reforms include lowering employee NICs while cutting self-employment NICs, additionally introducing the Triple Lock Plus and reforming the HICBC while abolishing stamp duty for first-time homebuyers. This will be partially offset by anti-tax avoidance spending which we assume falls largely on corporations, for an overall cost of £49.7bn.

-

PolicyEngine concludes that the manifesto would increase poverty by 5.8%, increasing the senior poverty rate by 19.0%.

-

The impacts of the manifesto would largely be regressive. The manifesto reduces disposable income for the bottom ten percent of people by 6.4%.

-

The majority of people in the five lowest income deciles would experience a negative impact on net income while the majority of people in the five highest income deciles would experience a positive net income change.

Introduction#

On June 11th, the Conservative and Unionist Party

For the first time, PolicyEngine will produce a comprehensive score of this and future manifestos, capturing an estimate of the economic impact of all spending and revenue changes.

In this report, we will walk through the key policy proposals and present the manifesto costings produced by the Conservatives alongside PolicyEngine replications of individual provisions. Costings in tables may not sum due to rounding. Where a proposal involves a tax-benefit policy modelled by PolicyEngine, we report how well we could replicate the Conservative claim.

Where a proposal is outside the scope of PolicyEngine’s model, we assume the Conservative spending or revenue estimate is fixed and apply an assumption about the incidence of the impact on UK households.

See the appendix for a full breakdown of our replication of the Conservatives’ tax cut

Spending#

The Conservatives propose a net spending decrease of £44bn through 2029. This would be driven primarily by procedural changes to welfare spending aimed at diminishing fraud and limiting eligibility (though without detail over specific eligibility changes), thereby lowering cost. This would be coupled with more minor cost-saving measures, including:

- Downsizing the civil service

- Lowering research and development funding

- Increasing international student visa fees

The Conservatives also propose spending increases to national defence, the NHS, and on some programs we classify as education-related (National Service and apprenticeship subsidies). Because none of these changes impact benefits modelled by PolicyEngine, we assume the Conservatives' costings and use the ONS’ estimates of the distributional impact of public service spending categories.

Taxes#

The Conservative manifesto balances its decrease in spending with a series of tax policy changes that generate a net negative budgetary impact of £49.7bn over the manifesto’s five-year period. These changes include:

- Lowering the employee NIC base rate step-wise to 6%

- Gradually abolishing self-employed NICs

- Increasing the personal allowance for pensioners with the Triple Lock Plus

- Ending the HICBC single-earner penalty

- Abolishing the Stamp Duty Land Tax (SDLT) for first-time homebuyers

These changes are underpinned by increased enforcement of anti-tax avoidance and evasion policies, which the Conservatives project to generate £20bn over the manifesto period, and which PolicyEngine projects would predominantly function as taxes upon capital (we assume their revenue estimate is correct).

We estimate that the Conservatives’ tax policy changes would have a slightly larger negative budgetary impact (£8.8bn) than the party manifesto. While most of our estimates were close to those of the manifesto, we find that ending the HICBC single-earner penalty would cost £10.2bn, as opposed to the Conservatives’ £4.5bn estimate.

We also find roughly double the budgetary impact of abolishing the Stamp Duty Land Tax (SDLT) for first-time homebuyers, at a cost of £4.4bn, versus the Conservatives’ estimate of £2.3bn.

Overall#

The Conservative manifesto, according to their costings, balances £41.9bn of tax cuts against £43.9bn generated by decreasing benefit spending, yielding a net budgetary surplus of £2bn. However, PolicyEngine’s estimate of the Conservatives’ total tax changes is £7.8bn higher than those in the manifesto, leading us to estimate an overall deficit of £5.8bn. As explained in the tax change section, this may be driven by modelling differences in the Conservatives’ HICBC policy costing, as well as assumptions on the housing market’s impact on the Conservatives’ stamp duty modifications.

In the chart below, negative numbers refer to increased government expenditures, while positive numbers refer to budgetary savings.

Economic impact#

PolicyEngine estimates that the complete Conservative manifesto would, in 2029:

- Cost £0.9bn

- Raise poverty by 6%

- Increase net income for 46% of the population, while decreasing it for 52%

We estimate the Conservatives’ manifesto to be

Impact by income decile

We also conclude that people in the lowest income deciles are more likely to experience the negative impacts of the proposal, with over 95% of people in the first income decile experiencing a decrease in net income. The majority of people in income deciles above the fifth start to experience net income increases with

Impacts within income deciles

Regarding poverty rates, PolicyEngine estimates that the proposed policy changes would

Poverty rate impacts

Conclusion#

The Conservative manifesto proposes a series of tax cuts, balanced with welfare spending cuts and anti-tax avoidance provisions, that the party projects to create a budgetary surplus of £2bn between 2025 and 2029. PolicyEngine estimates that these provisions would actually generate a budgetary deficit of £5.8bn, with key differences in modelled impacts of the Child Benefit High Income Tax Charge and the Stamp Duty tax cut for first-time buyers. We estimate that the Conservatives’ policies would redistribute income from those in the lowest brackets toward those in the uppermost, causing noticeable increases in inequality and poverty, particularly for seniors.

We welcome questions and comments on our findings or methodology- please feel free to

Appendix#

We estimate the following per-year scores for each of the tax provisions of the manifesto below.

PolicyEngine estimates of Conservative manifesto tax cuts.

These compare to the Conservatives’ estimates below.

Overall, we estimate differences in per-year revenue impacts of between £600m and £2.1bn.

Revenue impact, billions of pounds

nikhil woodruff

PolicyEngine's Co-founder and CTO

pavel makarchuk

Economist at PolicyEngine

anthony volk

Full-Stack Engineer at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

PolicyEngine is a registered charity with the Charity Commission of England and Wales (no. 1210532) and as a private company limited by guarantee with Companies House (no. 15023806).

© 2025 PolicyEngine. All rights reserved.