Research and analysis

Read PolicyEngine's research on recent and proposed policy reforms, as well as technical and general updates from the organisation.

59 results

22 April 2025

Analyzing Energy Policy with PolicyEngine

We provide an Earth Day recap of our capabilities in the US and UK.

26 March 2025

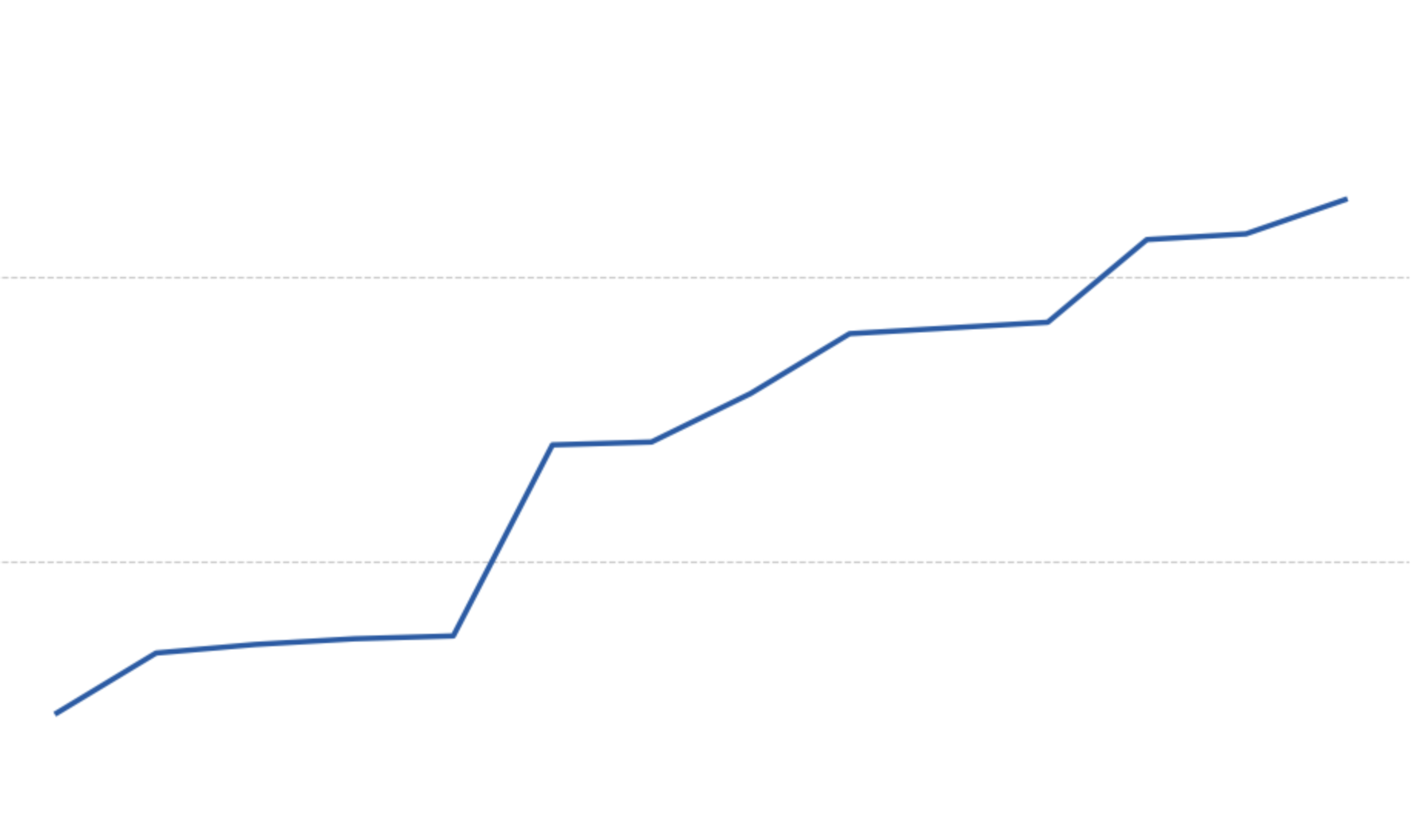

Analysis of the Spring 2025 OBR forecast

PolicyEngine integrates the new OBR forecasts to provide updated predictions on household income, poverty, and inequality.

25 March 2025

Extending the Income Tax threshold freeze to 2030

PolicyEngine estimates extending the personal allowance and higher rate threshold freeze would raise £12.2 billion over two years.

24 March 2025

HM Treasury pilots PolicyEngine UK for tax-benefit microsimulation

The UK government's finance ministry explores PolicyEngine as a potential supplement to existing models.

18 March 2025

Restricting eligibility for the Personal Independence Payment Daily Living part

We simulate potential realisations of the Government's new £5 billion reform.

11 March 2025

The impact of Personal Independence Payment, and freezing its level in 2025

How the disability benefit, and one reform the government is reportedly considering, affect the UK household sector.

6 March 2025

Exempting young children from the two-child limit

Analysis of the potential impact of limiting the two-child limit to families with children under 5 years old.

5 February 2025

How We're Improving our API in 2025

PolicyEngine's API target architecture for 2025.

28 December 2024

PolicyEngine UK in 2024: A year in review

From AI-powered analysis to election impact, we transformed policy research through technology.

26 December 2024

New AI feature helps people understand their taxes and benefits

We’re applying large language models to clarify complex policy rules.

19 December 2024

Nuffield Foundation awards £250k to enhance PolicyEngine UK

Grant will support expanding and localising tax-benefit microsimulation capabilities.

12 November 2024

How PolicyEngine UK models behavioural responses

PolicyEngine has enhanced its modelling with behavioural responses, including income, substitution and capital gains elasticities.

6 November 2024

Capital Gains Tax reforms in the Autumn Budget 2024

PolicyEngine estimates that the UK's 2024 Capital Gains Tax reforms will raise £6.4 billion between 2025-2029.

31 October 2024

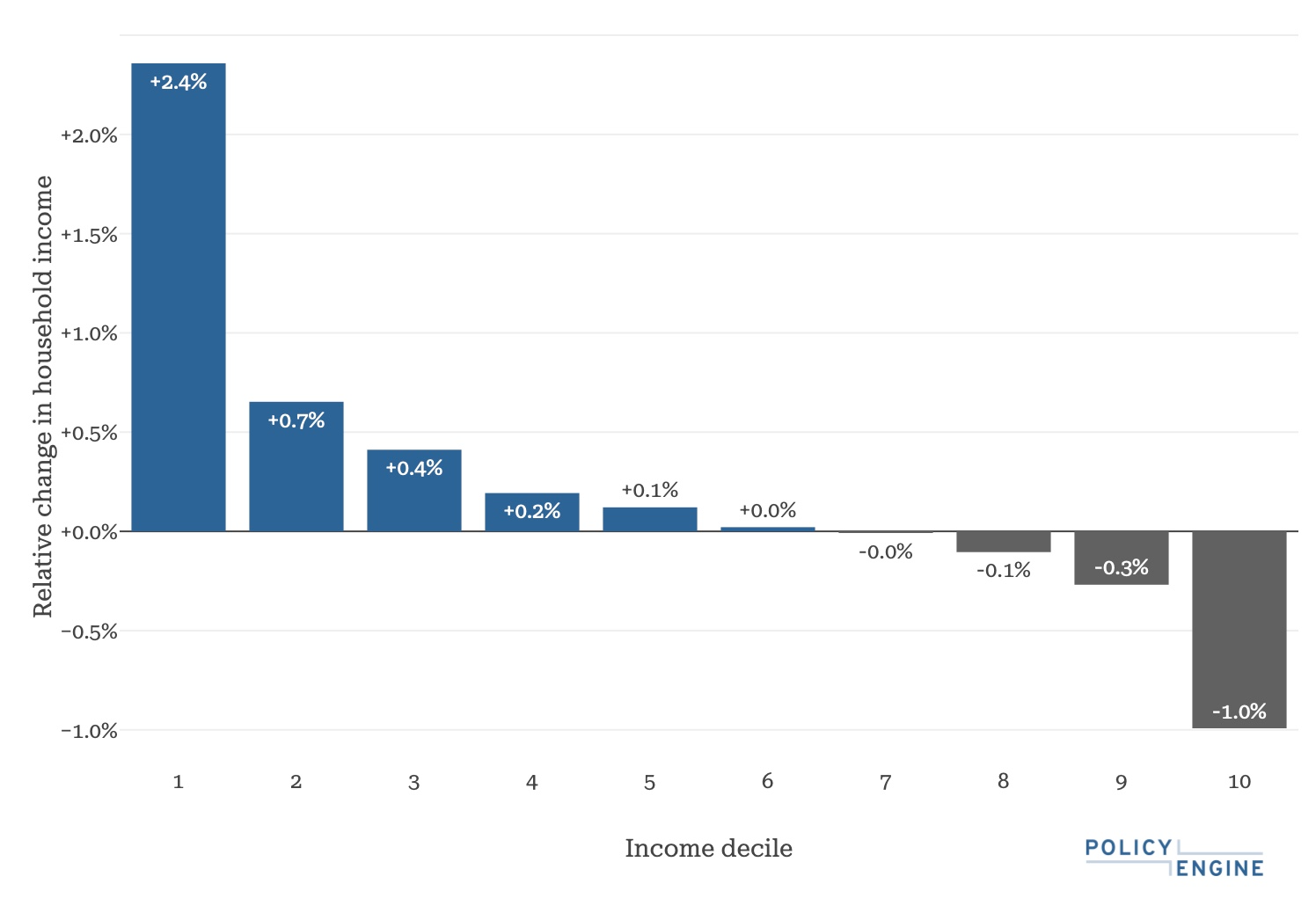

Benefits uprating 2025/26

PolicyEngine projects Labour's 1.7% benefits uprating would cost £2.5 billion, mainly benefiting lower-income households.

31 October 2024

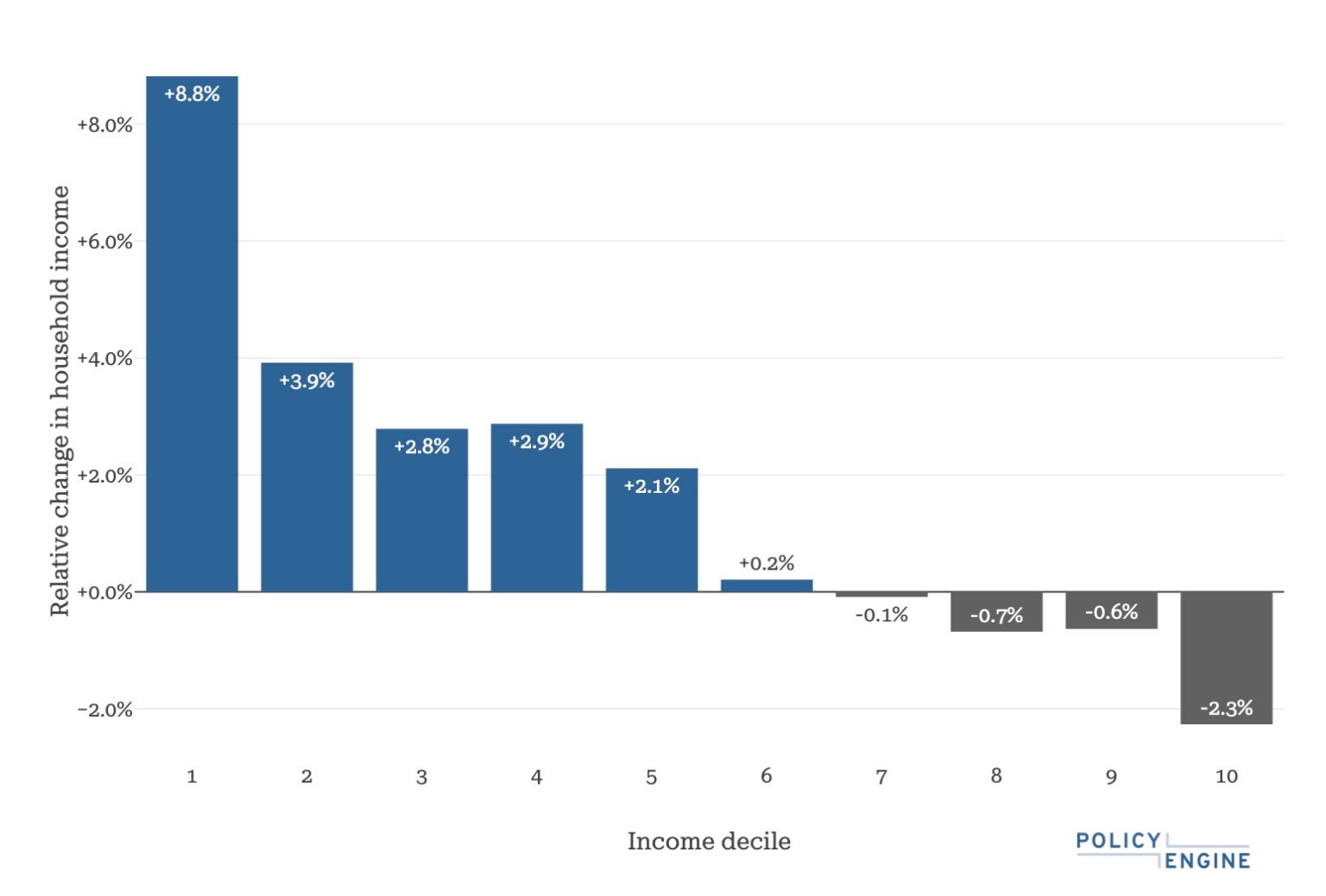

Levying VAT on private school fees in the Autumn Budget

PolicyEngine projects the reforms to private school VAT would raise £1.5 billion in 2025.

30 October 2024

Fuel duty reforms in the Autumn Budget 2024

PolicyEngine projects the reforms to fuel duty will cost £2.4 billion in 2025.

30 October 2024

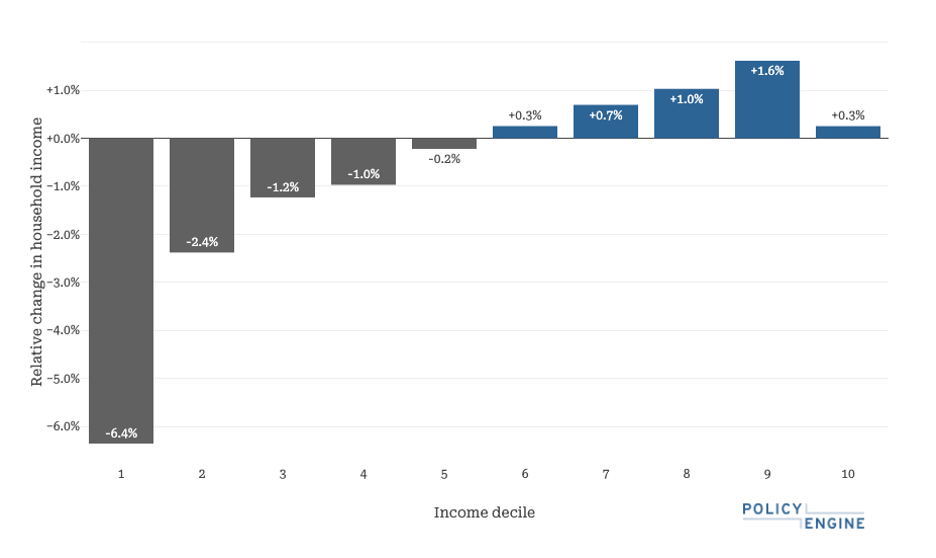

Employer National Insurance reforms in the Autumn Budget 2024

PolicyEngine projects the reforms to employer NI would raise £23 billion in 2025 and affect two thirds of people.

26 October 2024

Levying employer National Insurance on pension contributions

PolicyEngine estimates the now-scrapped Autumn Budget reform would have raised between £10 and £18 billion per year, depending on how employers pass it on to wages.

24 October 2024

Autumn Budget policy choices

PolicyEngine estimates that four reported tax reforms would raise £23 billion per year

17 October 2024

Labour's reforms to VAT tax on private schools

PolicyEngine projects Labour's private school tax plan would raise £7.7 billion over five years, mainly affecting wealthier households.

14 August 2024

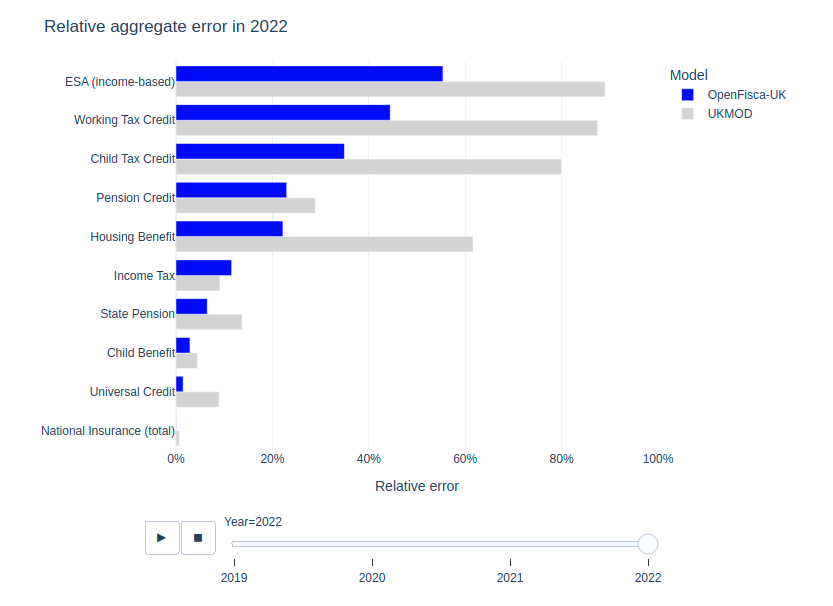

Validation against the Survey of Personal Incomes

Evaluating PolicyEngine's model performance against the UK SPI.

29 June 2024

The Labour Party Manifesto

PolicyEngine's comprehensive impact score.

12 June 2024

The Conservative Manifesto

PolicyEngine's comprehensive impact score.

11 June 2024

The Liberal Democrat Manifesto

PolicyEngine's comprehensive impact score.

28 May 2024

The Triple Lock Plus

PolicyEngine estimates the impact of the UK government's proposed pension uprating policy reform.

16 April 2024

PolicyEngine's Spring 2024 update

How PolicyEngine compares to the latest external forecasts.

6 March 2024

Spring Budget 2024

PolicyEngine estimates the impact of the UK Spring Budget.

4 March 2024

Spring Budget 2024 proposals

PolicyEngine estimates reported likely tax-benefit reforms ahead of the UK Spring Budget.

4 December 2023

Autumn 2023 model calibration update

Evaluating PolicyEngine's model performance with the latest official statistics.

22 November 2023

Autumn Statement 2023 tax-benefit reforms

Chancellor Jeremy Hunt just announced National Insurance cuts and benefit uprating. We've evaluated these reforms.

4 November 2023

New King's College London research uses PolicyEngine

A ‘Citizens' Economic Council' explores PolicyEngine-scored tax-benefit impacts.

7 August 2023

Repealing the Universal Credit two-child limit

How removing the limit of some benefits to two children would affect the UK in 2023.

26 April 2023

Digital Public Goods Alliance recognizes PolicyEngine as a Digital Public Good

The UN-endorsed initiative highlights PolicyEngine's open source approach to supporting the Sustainable Development Goals.

3 April 2023

Revolutionizing policy analysis with AI

Discover PolicyEngine's new GPT-4 integration and audience modes.

28 March 2023

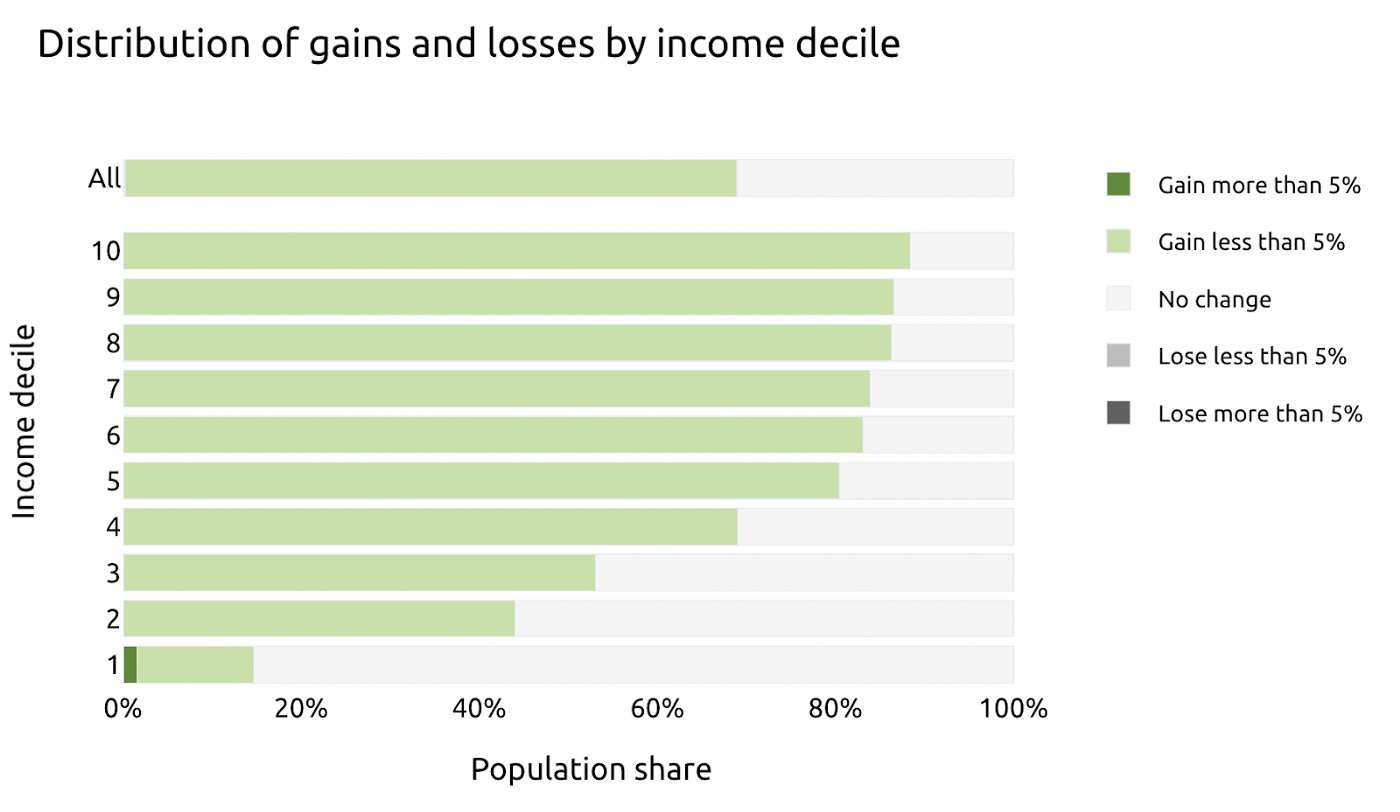

Breaking down policy impacts by wealth decile

Income isn't everything.

17 March 2023

Automate policy analysis with PolicyEngine's new ChatGPT integration

Score an economic impact in a few clicks. Write a report in one more.

15 March 2023

Analysis of the Spring Budget 2023

PolicyEngine analysis estimates the impact of the EPG extension and the fuel duty freeze.

8 March 2023

Breaking down poverty impacts by sex

PolicyEngine estimates the impact of customisable policy reforms on poverty — overall, by age, and now by sex.

5 March 2023

The UK's extended Energy Price Guarantee

Analysis by PolicyEngine on the expected effects on income, poverty, and inequality.

15 February 2023

OpenFisca wins Edge of Government's Innovation Award

The success of Rules as Code and its impact on citizens.

9 February 2023

Reform UK's Emergency Recovery Plan

See the UK party's proposed deficit-funded tax cuts in PolicyEngine

12 January 2023

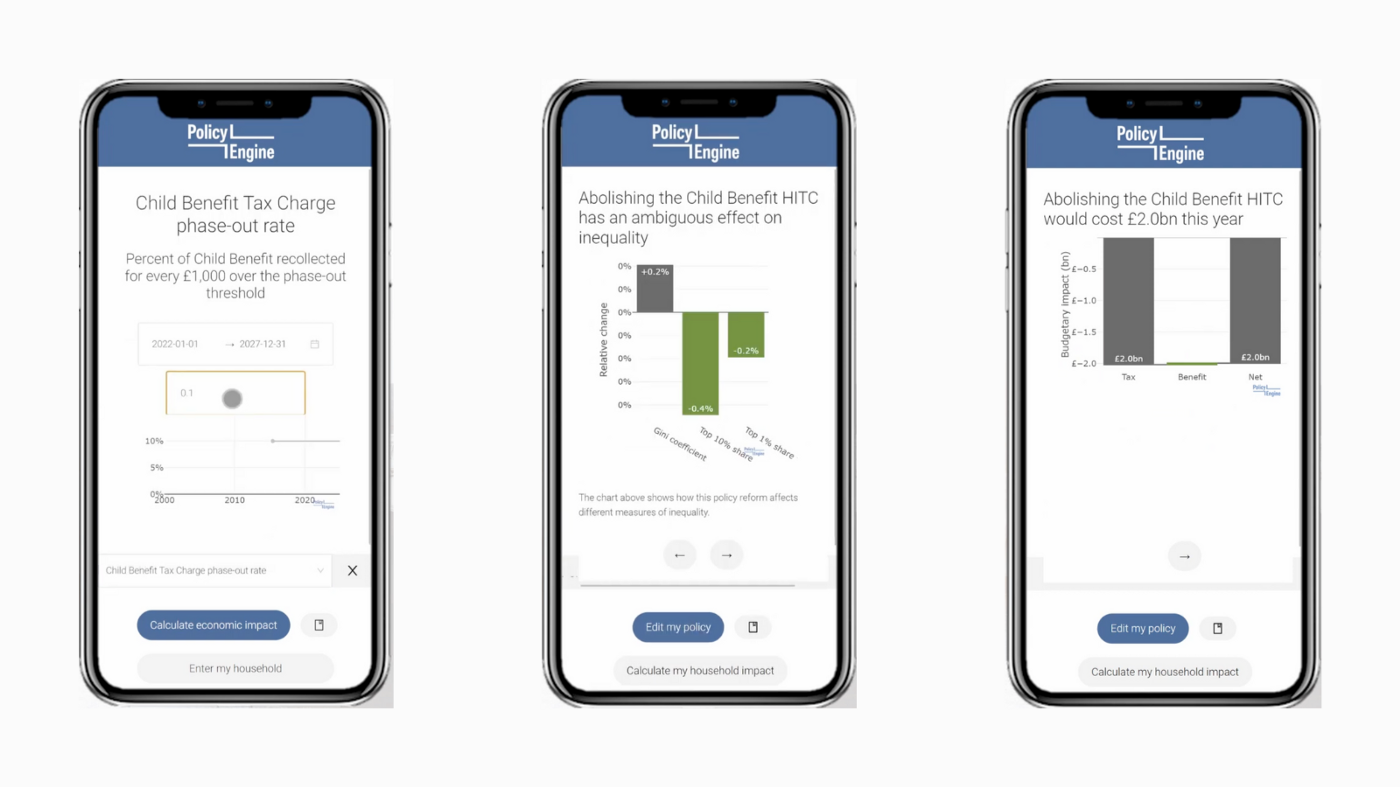

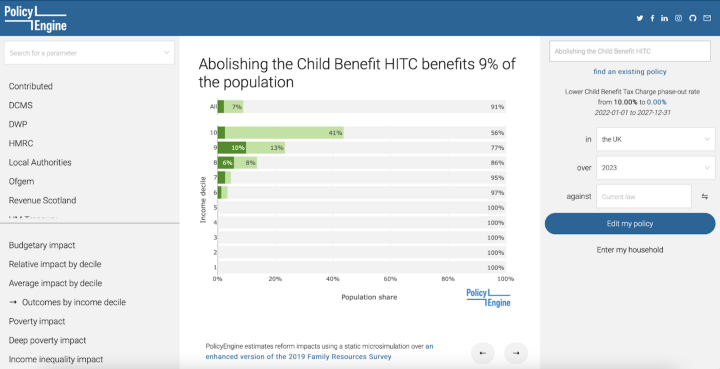

The New PolicyEngine

We're taking economic policy to the next level with the most accessible tax and benefit model ever built.

12 January 2023

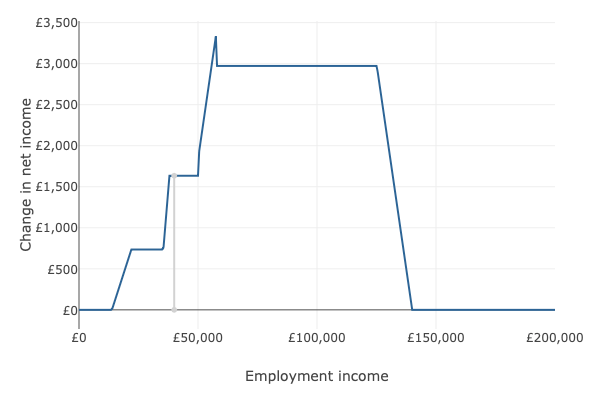

From idea to impact: scoring a policy reform on the new PolicyEngine UK

A walkthrough of the new app on a UK tax-benefit reform.

30 December 2022

PolicyEngine's 2022 year in review

A year of launches, analysis, and building for the future.

10 November 2022

From OpenFisca to PolicyEngine

OpenFisca has catapulted our progress, and now we've forked it into our own microsimulation framework.

23 September 2022

Tax cuts in Prime Minister Truss's Growth Plan 2022

See the impact on the population and on your household in PolicyEngine UK.

22 September 2022

Stamp duties in PolicyEngine UK

The Times reported yesterday that Prime Minister Liz Truss will announce plans to cut Stamp Duty this week. PolicyEngine now supports…

16 September 2022

Prime Minister Liz Truss’s energy bill price cap

See the impact in PolicyEngine.

29 August 2022

Raising the marriage allowance from 10% to 100%

See the reform in PolicyEngine.

1 August 2022

Rishi Sunak’s proposal to cut the basic rate to 16 percent

See the interactive simulation on PolicyEngine

26 May 2022

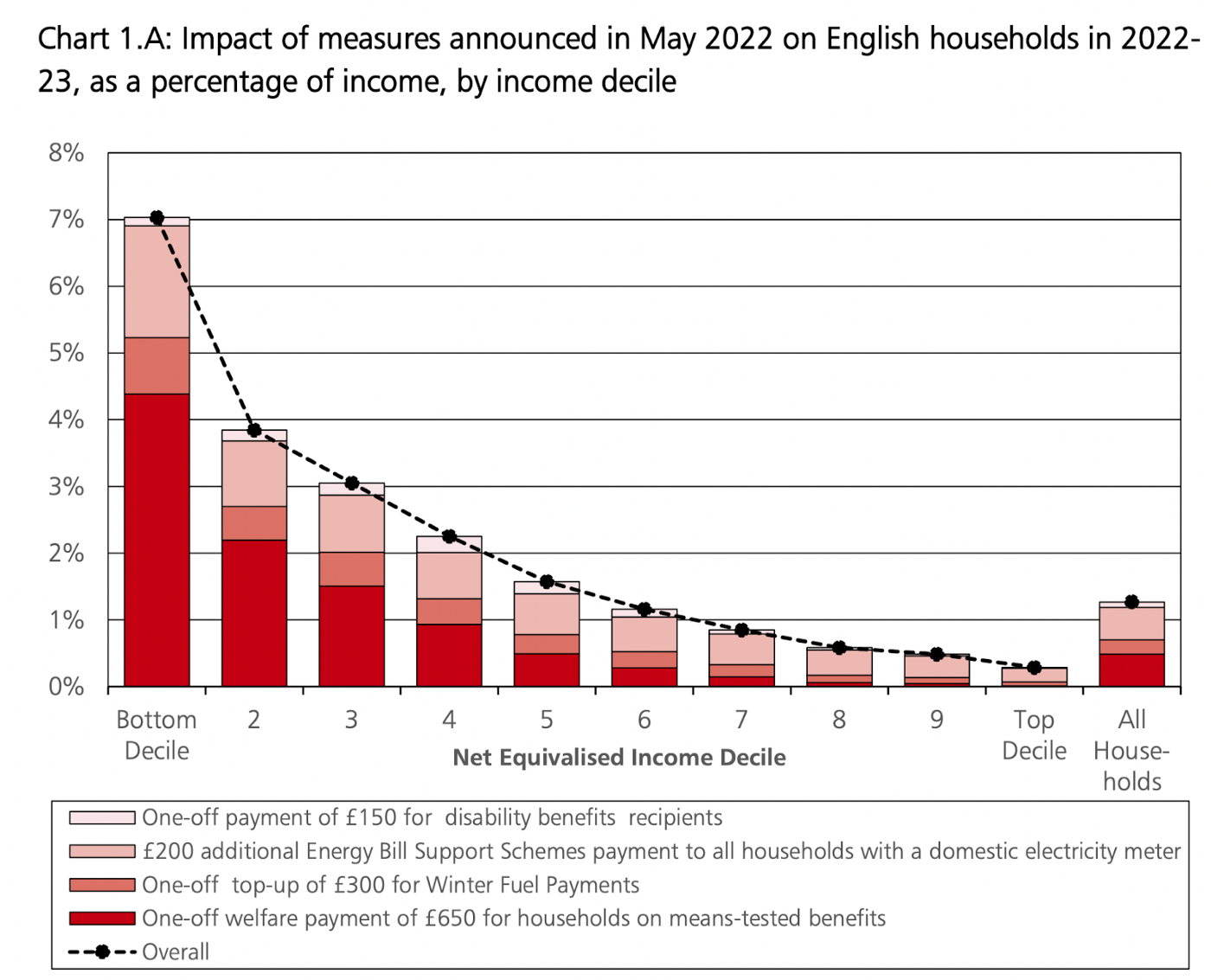

Impact of the Chancellor’s Cost of Living Support package

See the analysis in PolicyEngine UK

29 April 2022

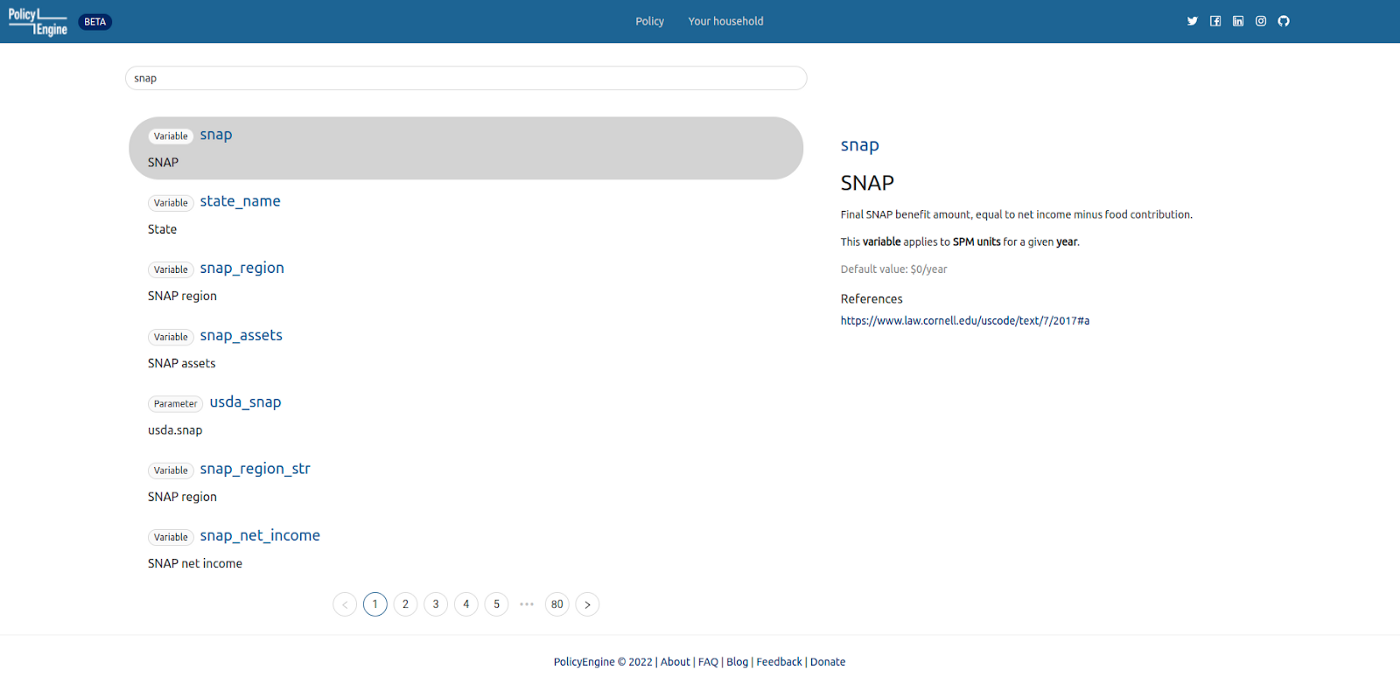

How developers can explore the PolicyEngine API

The UK API explorer and US API explorer describe variables and policy parameters in our models.

23 April 2022

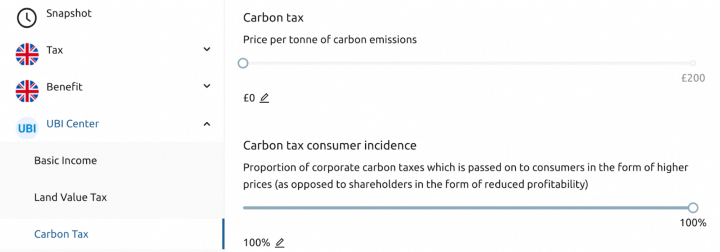

How PolicyEngine estimates the effects of UK carbon taxes

By fusing datasets with machine learning, we empower anyone to integrate custom carbon taxes with other tax and benefit reforms.

7 March 2022

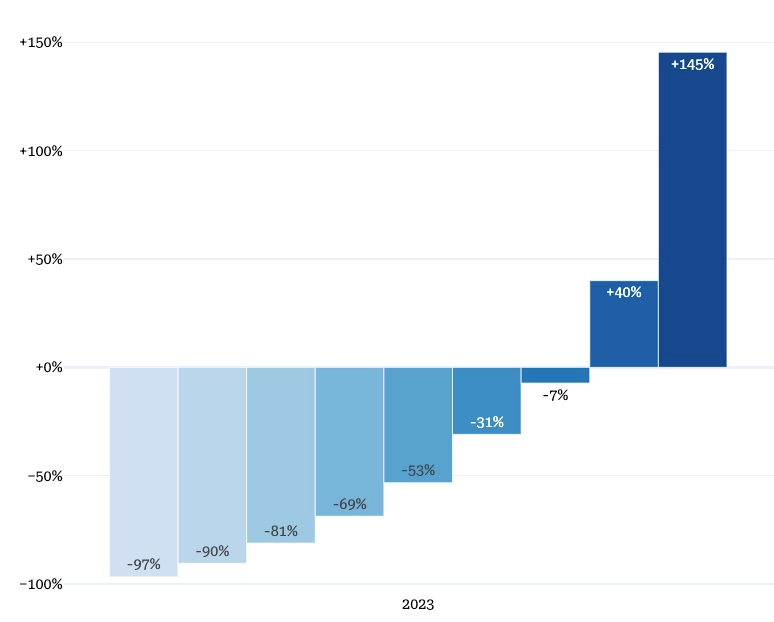

How machine learning tools make PolicyEngine more accurate

Today, we're launching new survey weights that cut deviations from administrative statistics by 97%.

26 January 2022

The Green Party Manifesto at PolicyFest

Explore the Green Party Manifesto on PolicyEngine.

29 December 2021

PolicyEngine's 2021 year in review

PolicyEngine's inaugural year was a substantial one for public policy.

4 December 2021

Income Tax cuts Rishi Sunak is reportedly considering

Explore the basic rate and additional rate cuts in PolicyEngine.

30 October 2021

Analysing Autumn Budget Universal Credit reforms with PolicyEngine

See how the reform affects the UK population or your household.

15 October 2021

Make Everyone a Policymaker

Today we're (re)launching PolicyEngine to give the public unprecedented insight into the tax and benefit system.

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

PolicyEngine is a registered charity with the Charity Commission of England and Wales (no. 1210532) and as a private company limited by guarantee with Companies House (no. 15023806).

© 2025 PolicyEngine. All rights reserved.