The Labour Party Manifesto

PolicyEngine's comprehensive impact score.

Contents

Key findings

Introduction

Spending

Revenue

Economic impact

Conclusion

Notes

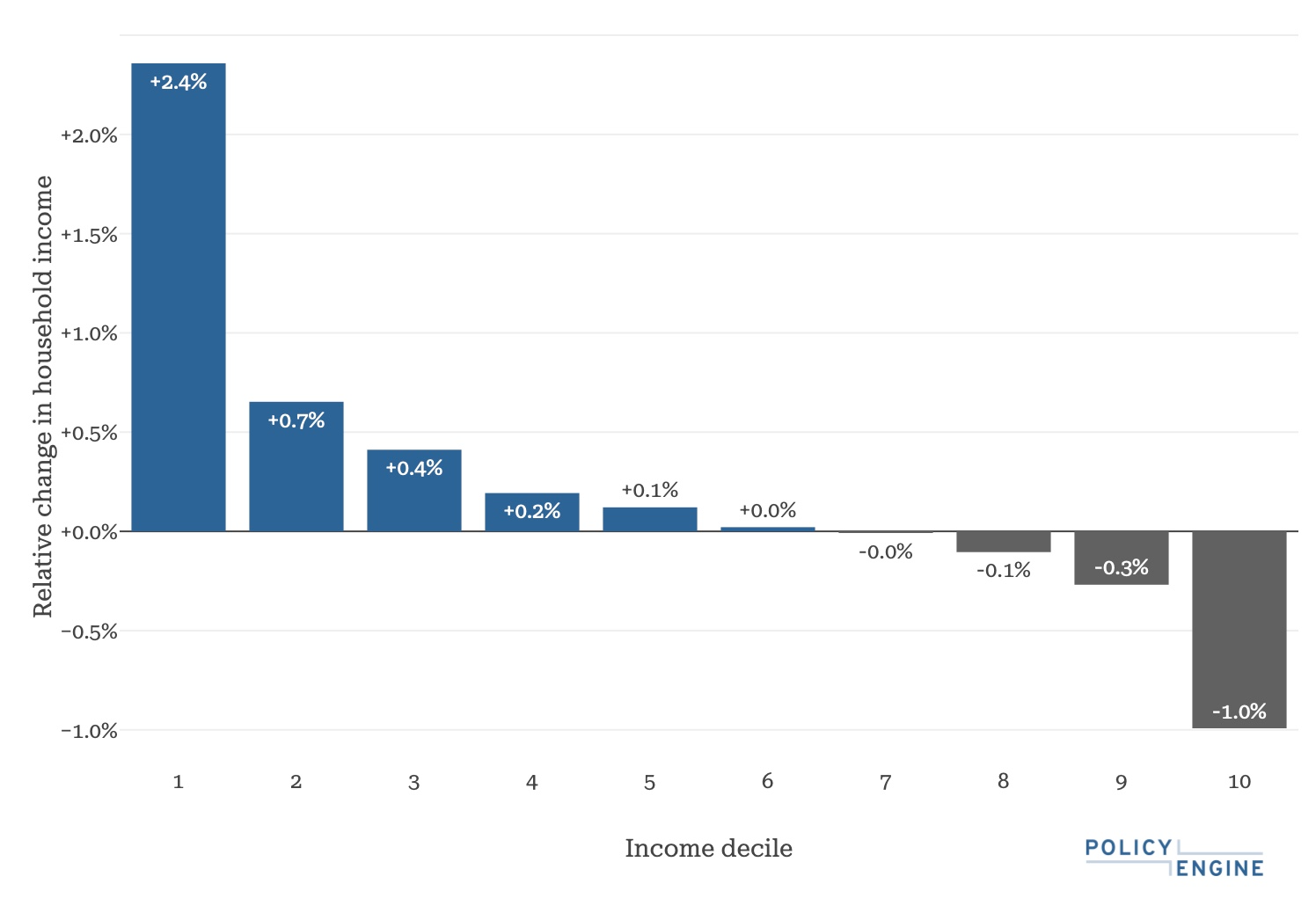

Distributional impact of the Labour 2024 Manifesto. See the full impact score

Key findings#

- Labour propose a budget-surplus plan which raises £7.5bn and spends £4.2bn, benefiting 73% of people.

- Spending reforms are largely focussed on public services, while tax reforms are likely to be incident mostly on high-earners.

- PolicyEngine estimates that the private school VAT application is progressive along income deciles.

- We project that the lowest income decile would see a 2.4% rise in net income, while the top decile would see a 1% fall in net income.

- We also project modest reductions in absolute poverty and inequality.

Introduction#

On June 13, Labour

In the manifesto, Labour set out a revenue-positive series of priorities. In fiscal year 2028-29, the party aims to raise £7.4bn through tax revisions and spend £4.8bn funding new expenditures, with the majority of this value allocated to increased NHS spending, NHS-adjacent healthcare programs, and education programs.

For the first time, PolicyEngine will produce a comprehensive score of this and future manifestos, capturing an estimate of the economic impact of all spending and revenue changes.

In this report, we will walk through Labour’s key policy proposals and present the manifesto costings produced by Labour alongside PolicyEngine replications of individual provisions. Costings in tables may not sum due to rounding. Where a proposal involves a tax-benefit policy modelled by PolicyEngine, we report our alignment to the Labour claim.

Where a proposal is outside the scope of PolicyEngine’s model, we assume the Labour spending or revenue estimate is fixed and apply an assumption about the incidence of the impact on UK households.

Spending#

Labour proposes a net spending increase of £4.8bn in 2028-29. The bulk of this spending would be allocated to new or expanded health and education programs, the most significant of which would include:

- Funding 40,000 more weekly NHS operations, scans, and appointments

- Increased funding to HMRC to reduce tax avoidance

- Hiring 6,500 new teachers

- Recruiting 8,500 new mental health employees

- Providing free breakfast clubs in every primary school

None of these involve changes to benefits modelled by PolicyEngine, so we assume their cost estimates and use the ONS’ estimates of the distributional impact of public service spending categories.

Revenue#

Labour’s manifesto also proposes a £7.4 billion increase in tax revenues, funded through four tax policy revisions:

- Removal of the non-domiciled tax status and investments in reducing tax avoidance

- Application of VAT and business rates to private school tuition fees

- Application of standard income tax rates to carried interest

- An increase of 1% to the residential property stamp duty for non-UK residents

PolicyEngine models the impact of levying VAT on private schools, largely following the evidence base contributed by

In order to capture the likely distributional impact of non-dom status removal, we represent this as a tax on income over £100,000 raising £3.2bn in revenue.

Economic impact#

PolicyEngine estimates that in 2028 the Labour Party manifesto would:

- Raise £3.3bn

- Lower poverty by 2%

- Raise net income for 73% of people

We estimate that gains would be progressive along income lines, with the lowest decile seeing a 2.4% increase in net income and the highest decile seeing a 1% loss.

Impact by income decile

We also estimate that people in lower and middle income deciles are highly likely to benefit. Only the top decile sees a majority of people come out behind, and more than 80% in each of the bottom eight deciles come out ahead or the same.

Winners and losers by income decile

On poverty, we estimate modest reductions in absolute poverty across all age groups, particularly aimed at seniors. We also project that the Gini index of income inequality would by 0.6%.

Poverty impact by age group

Conclusion#

The Labour manifesto redistributes £4.2bn and raises £3.3bn surplus revenue progressively, with small tax rises largely concentrated on the highest income decile funding public spending that benefits the lower and middle of the income distribution the most. We estimate this causes a small reduction in absolute poverty, and an increase in living standards for 73% of the population.

Notes#

-

Where a policy is clearly a tax on corporations or consumption, we distribute the burden according to imputed corporate wealth and consumption, respectively. For public service budget changes we apply the ONS’ estimates of public service consumption by income decile. Where a policy is clearly only incident on high incomes, we model it as a progressive tax after an appropriate income level.

↩ -

See our open-source model addition

here . We do not model the business rate increase.↩ -

Advani et al found that only 0.3% of people who have ever been non-doms earn less than £100,000, and non-dom status becomes more prevalent at higher incomes.↩

nikhil woodruff

PolicyEngine's Co-founder and CTO

anthony volk

Full-Stack Engineer at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

PolicyEngine is a registered charity with the Charity Commission of England and Wales (no. 1210532) and as a private company limited by guarantee with Companies House (no. 15023806).

© 2025 PolicyEngine. All rights reserved.