The Liberal Democrat Manifesto

PolicyEngine's comprehensive impact score.

Contents

Key findings

Introduction

Spending

Taxes

Economic impact

Conclusion

Notes

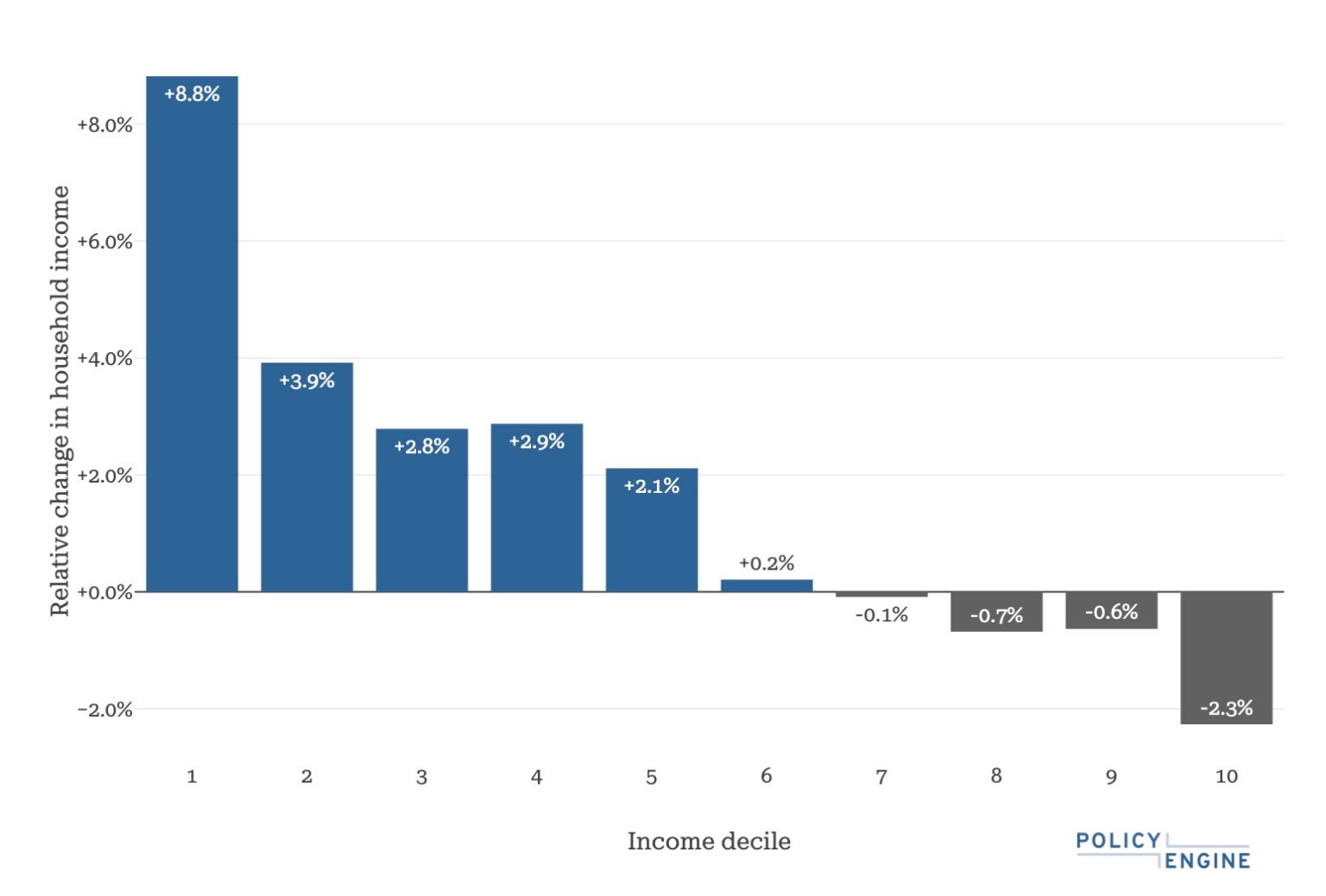

Distributional impact of the Liberal Democrat 2024 Manifesto. See the full impact score

Key findings#

-

The Liberal Democrats propose a budget-neutral plan with equal spending and revenue increases of £26.8bn.

-

Welfare reforms include increasing Carer's Allowance, removing the two-child limit and benefit cap on Universal Credit. PolicyEngine estimates these reforms would cost £5.5bn.

-

Tax reforms focus on Capital Gains Tax, taxes on corporations, and consumption taxes, raising an estimated £26.5bn.

-

PolicyEngine estimates that the manifesto would lower absolute poverty by 20%, raise net income for 70% of people, and be progressive along income lines.

-

The lowest income decile would see a 9% increase in disposable income, while the highest decile would see a 2% loss.

-

Child poverty would be reduced by a quarter, lifting 1.3m children out of poverty. Overall, 2.4m people would be lifted out of poverty, and income inequality would decrease by over 3% according to the Gini index.

Introduction#

Yesterday the Liberal Democrats

For the first time, PolicyEngine will produce a comprehensive score of this and future manifestos, capturing an estimate of the economic impact of all spending and revenue changes.

In this report, we will walk through the key policy proposals and present the manifesto costings produced by the Liberal Democrats alongside PolicyEngine replications of individual provisions. Costings in tables may not sum due to rounding. Where a proposal involves a tax-benefit policy modelled by PolicyEngine, we report how well we could replicate the Liberal Democrat claim.

Where a proposal is outside the scope of PolicyEngine’s model, we assume the Liberal Democrat spending or revenue estimate is fixed and apply an assumption about the incidence of the impact on UK households.

Spending#

The Liberal Democrats propose a net £26.8bn spending increase, and include several welfare reforms among other public services reforms. The welfare changes include:

- Increasing Carer’s Allowance by £20 per week, “raising the amount carers can earn and introducing an earnings taper to end the unfair cliff edge”.

- Removing the two-child limit to Universal Credit

- Removing the benefit cap

As it is currently specified, the Carer’s Allowance reform would not produce the cost estimated by the Liberal Democrats. Although we can replicate that their £20 per week increase would cost around £1bn (assuming their unspecified means test relaxation costs around 450m), most of this cost would be offset by reduced Universal Credit payments. If we assumed that the party would end the 1-1 reductions in Universal Credit for Carer’s Allowance payments, this would add an additional £3bn to the cost element. Because of this, we estimate the Carer’s Allowance as stated in the manifesto would only benefit households by 10% as much as the Liberal Democrats estimate.

We estimate that ending the two-child limit and the benefit cap would cost £3.4bn and £700m individually. When these welfare reforms are combined, their total cost rises from £4.4bn to £5.5bn because of interactions between the policies.

Combined with increases to education, healthcare and other public service budgets, we reach the same £26.8bn cost estimate as the party’s manifesto costings.

Taxes#

The manifesto proposes a £26.5 increase in tax revenues. We separate this into three distinct areas: taxes on capital gains, taxes incident largely on owners of capital, and taxes incident largely on consumers.

The Liberal Democrats propose reforms to Capital Gains Tax, including raising the Annual Exempt Amount (AEA) to £5,000 (from £3,000). We estimate this raises £300m on its own. The party also proposes several reforms to the tax which do not have enough detail to reproduce: “adjusting the rates”, “a new tax-free allowance for inflation”, and “introducing a relief for small businesses”. We estimate that a 5p rise in all Capital Gains Tax rates together with the AEA increase would match the Liberal Democrat-provided cost estimate of £5.2bn.

We estimate that of the remaining £21.3bn in tax rises, £17.7bn would be largely incident on owners of capital and £3.6bn would fall on consumers. When combined with the Capital Gains Tax reforms, we reach a very slightly (£400m) lower revenue estimate of £26.5bn to the party’s £26.9bn.

Economic impact#

PolicyEngine estimates that the combined Liberal Democrat manifesto would, in 2024:

- Cost £200m

- Lower absolute poverty by 20 percent (of the current poverty rate)

- Raise net income for 70% of people

We also estimate that this level of redistribution would be progressive along income lines, with the lowest income decile seeing a 9% increase in disposable income, and a loss of 2% for the highest income decile.

Impact by income decile

We also estimate that people in lower income deciles are more likely to be better off under the plans than those in higher deciles, though the lowest decile still has 10% of people worse off under the manifesto policy.

Impacts within income deciles

On poverty rates, PolicyEngine estimates that the manifesto policy would reduce absolute child poverty by a quarter, lowering the number of children in poverty by 1.3m and the number of people in poverty by 2.4m. We also estimate that the Gini index of income inequality would fall by over 3%.

Poverty rate impacts

Conclusion#

The Liberal Democrat manifesto redistributes £27bn progressively, largely from owners of corporations to consumers of healthcare, welfare and other public services. We estimate this causes large reductions in poverty and inequality, and with 70% of the population benefiting at the expense of a largely higher-income 30%.

We welcome questions and comments on our findings or methodology- please feel free to

Notes#

-

Where a policy is clearly a tax on corporations or consumption, we distribute the burden according to imputed corporate wealth and consumption, respectively. For public service budget changes we apply the ONS’ estimates of public service consumption by income decile.

↩

nikhil woodruff

PolicyEngine's Co-founder and CTO

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

PolicyEngine is a registered charity with the Charity Commission of England and Wales (no. 1210532) and as a private company limited by guarantee with Companies House (no. 15023806).

© 2025 PolicyEngine. All rights reserved.