Reform UK's Emergency Recovery Plan

See the UK party's proposed deficit-funded tax cuts in PolicyEngine

Contents

Reform UK’s proposals

Overall budgetary impact

Distributional impact

Poverty and inequality

Work incentives

See the effect on your household

In June 2022, Reform UK adopted a set of policy proposals advocating broad tax cuts, funded by deficit spending. In this report, we analyse the provisions of this policy package using PolicyEngine tax-benefit modelling, comparing budgetary impacts against those reported by Reform UK and computing distributional impacts across the income spectrum.

Reform UK’s proposals#

The

Provisions in Reform UK’s Emergency Recovery Plan, alongside PolicyEngine’s cost estimates.

For this analysis, we considered only those occurring over the next year (therefore excluding the tax inflation indexing). We also excluded the abolition of environmental levies, non-household fuel duty and government spending cuts- these are currently out of the scope of our model.

Overall budgetary impact#

In total, we project that these reforms would reduce tax revenues by £67 billion if enacted over 2023. Welfare spending would automatically fall by £915 million due to means testing, resulting in an net cost of £66.1 billion.

Overall budgetary impact of the Economic Recovery Plan.

Distributional impact#

We estimate that the average household’s income would rise by 6%, with gains highest for the seventh decile and lowest for the tenth (largely because many households in the tenth decile cannot benefit from the Personal Allowance increase due to being over the phase-out region).

Relative change to net income by decile under the Economic Recovery Plan.

The first income decile sees an average income gain of £468, compared to £5,350 for the top decile.

Absolute change to net income under the Economic Recovery Plan.

By lowering consumption and income taxes together, the reforms reach all households, and 81% of households see their net income rise by over 5%. This ‘strong increase’ is lowest for the second decile at 58%, rising to 99% in the ninth decile.

Distribution of outcomes by income decile under the Economic Recovery Plan.

Poverty and inequality#

Under the proposed reforms, we estimate that the absolute, before-housing-costs poverty rate would fall by 2 percentage points (12.6%), representing a net decrease of 1.3 million people experiencing poverty. Deep poverty also falls 7%, from 2.3% to 2.2%.

The Emergency Recovery Plan would reduce income inequality according to the three measures we report.

Change to inequality metrics under the Economic Recovery Plan.

Work incentives#

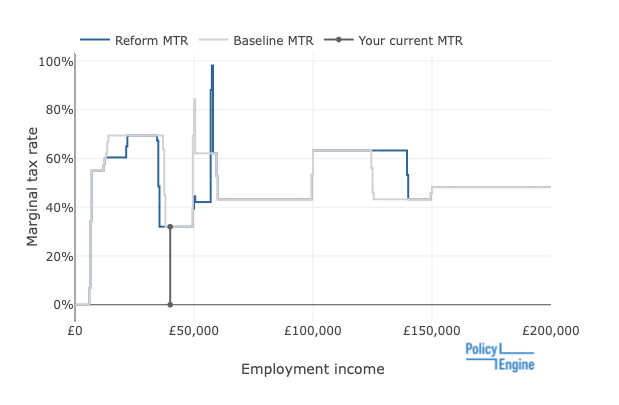

The Economic Recovery Plan would have mixed effects on work incentives. The Personal Allowance increase reduces marginal tax rates for low and middle income households, while raising marginal tax rates for those on higher incomes.

For example, a married couple with two children would see their marginal tax rate fall by 9% while they remain within Universal Credit eligibility (the marginal rate does not fall by the full 20% basic rate due to the Universal Credit taper). As a result of the reforms, they would exit UC eligibility earlier, lowering marginal tax rates by up to 37 percentage points.

However, once reaching the higher rate threshold, they face a work disincentive that is now more punitive under the Economic Recovery Plan: the Marriage Allowance income limit. Under the Marriage Allowance, couples can transfer up to 10% of the Personal Allowance to the higher earner of the two, if that higher earner is a basic rate taxpayer. This causes a sudden increase in tax liability (usually described as a

Further up the income spectrum, another work disincentive under current law is the phase-out of the Personal Allowance, at a rate of 50p per £1 earned over £100,000. This causes a 62% marginal tax rate under current law between £100,000 and £125,000; under the Economic Recovery Plan, this high-marginal tax rate region would be extended to £140,000.

Change to marginal tax rate by employment income, for a single-earner married couple with two children.

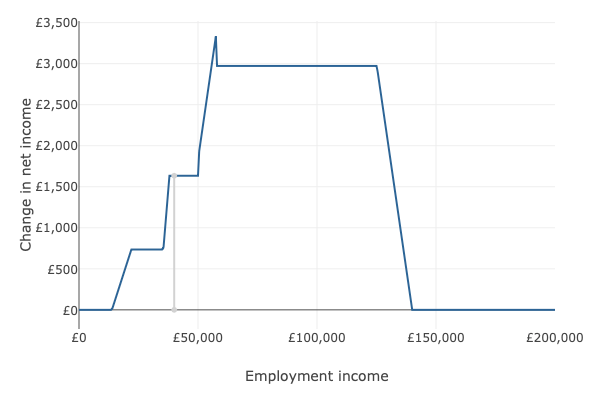

Reflecting this, the overall change to net income phases in until £65,000. After this point, gains are smoothly tapered away after £125,000 before reaching zero.

Change to net income by employment income, for a single-earner married couple with two children.

See the effect on your household#

As always, you can

nikhil woodruff

PolicyEngine's Co-founder and CTO

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

PolicyEngine is a registered charity with the Charity Commission of England and Wales (no. 1210532) and as a private company limited by guarantee with Companies House (no. 15023806).

© 2025 PolicyEngine. All rights reserved.