Rishi Sunak’s proposal to cut the basic rate to 16 percent

See the interactive simulation on PolicyEngine

Contents

Budgetary impact

Poverty

Distributional impact

Sample household

In a pitch today for Conservatives to elect him Prime Minister,

PolicyEngine estimates that cutting the basic rate from 20p to 16p in 2022 would:

-

Cost £18.8 billion

-

Lower the poverty rate by 1.2 percent

-

Benefit higher income households more than lower income households

-

Produce a mixed impact on income inequality

Budgetary impact#

The reform would lower tax revenues by £19.0 billion, and also lower benefit outlays by £0.2bn, for a total budgetary impact of £18.8 billion. Lowering tax rates lowers benefit outlays because programs like Universal Credit phase out based on after-tax income.

PolicyEngine is a “static” model, meaning that it assumes no behavioural responses. In its dynamic model that assumes behavioural responses,

Poverty#

The reform would cut poverty 1.2% overall. The effect is larger for children (1.7%) and small for seniors (0.1%). It would not affect deep poverty, the share of people in households with income below half their poverty threshold.

Distributional impact#

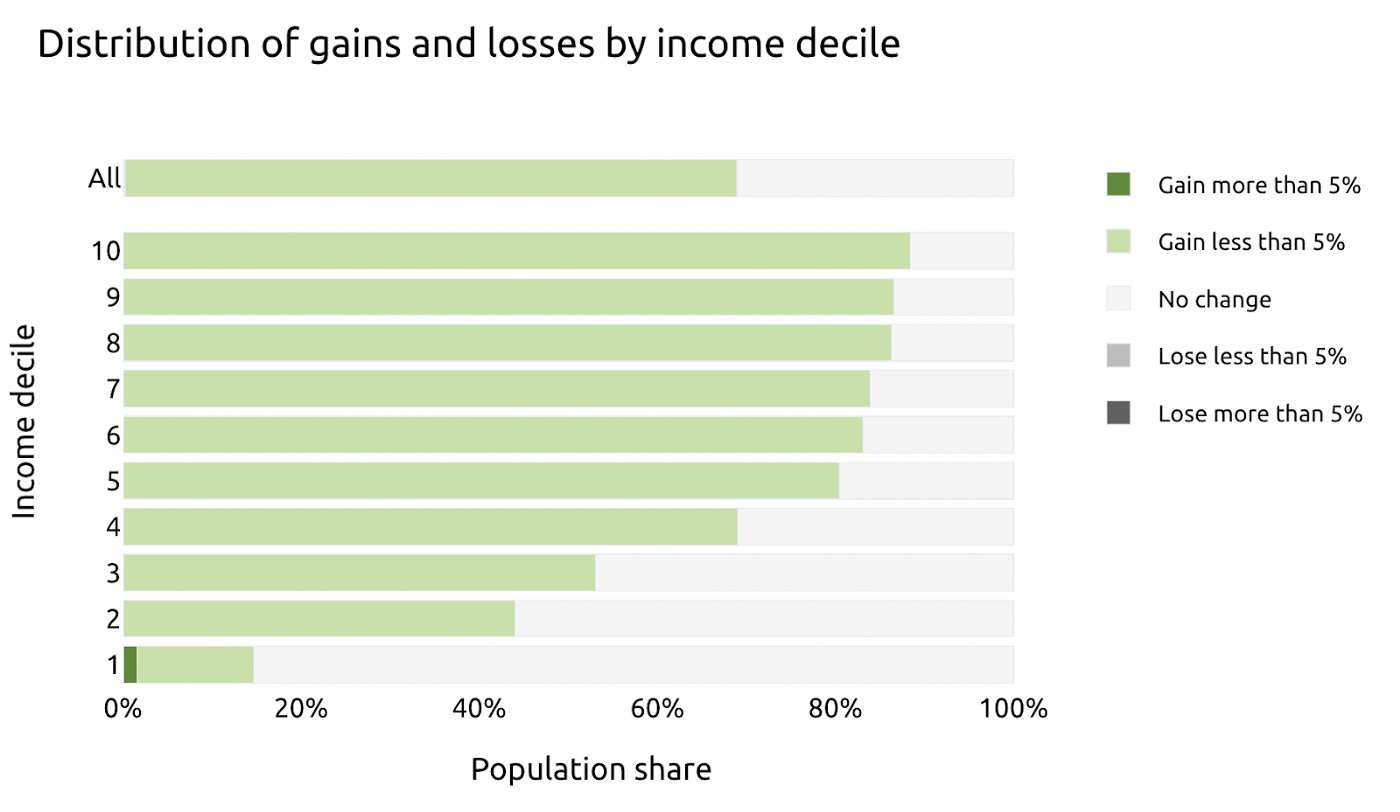

The reform generally benefits higher income households more: as a percent of net income, the average benefit rises for each decile, except for the top decile which gains about as much as the seventh decile.

Higher income households are also more likely to gain.

While the reform would increase the Gini index, a broad measure of income inequality, it would have a small effect on the share of net income held by the top 10% and reduce the share held by the top 1%.

Sample household#

A single parent of one would start to benefit from the basic rate cut once they earn about £13,000. Because Income Tax interacts with Universal Credit, the gain increases at different rates, until it plateaus at £1,508 once their earnings hit £50,300.

For the income range where this household is eligible for Universal Credit, the reform lowers their marginal tax rate by 1.8%; beyond that, it falls by the full 4% cut.

To compute more impacts of Sunak’s proposed basic rate cut,

max ghenis

PolicyEngine's Co-founder and CEO

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

PolicyEngine is a registered charity with the Charity Commission of England and Wales (no. 1210532) and as a private company limited by guarantee with Companies House (no. 15023806).

© 2025 PolicyEngine. All rights reserved.