Individual income tax provisions of President Biden's 2025 Budget

PolicyEngine projects the impact of expanding tax credits and raising taxes on high-income filers.

Contents

The reforms

Restoring the 2021 Child Tax Credit expansion

Restoring the 2021 Earned Income Tax Credit expansion for filers without qualifying children

Increasing the top marginal rate to 39.6%

Increasing the Medicare and Net Investment Income taxes

Provisions not modeled

Combined household impacts

Single person

Family of four

Nationwide results

Conclusion

Appendix A: Budgetary breakdown

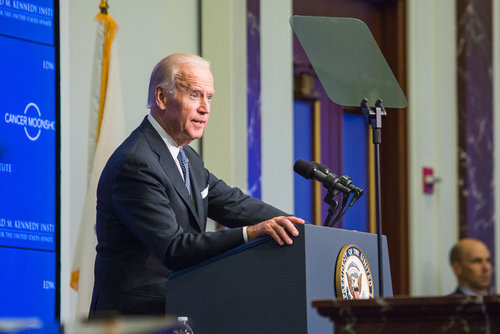

President Biden introduced his

-

Restoring the 2021 Child Tax Credit expansion

-

Restoring the 2021 Earned Income Tax Credit expansion for filers without qualifying children

-

Raising the top marginal tax rate to 39.6%

-

Increasing the Medicare and Net Investment Income taxes

We estimate that, in 2024 and assuming no behavioral responses, these reforms would cost $40.5 billion, lower poverty 12%, and lower income inequality. 59% of Americans would see a higher net income, while 3% would see a lower net income. This report describes these impacts in more detail, and examines effects on individual households.

See how President Biden’s 2025 Budget affects your household with our

The reforms#

Here we summarize the four provisions of Biden’s 2025 Budget that PolicyEngine models, based on the

Restoring the 2021 Child Tax Credit expansion#

Biden’s budget restores the expansion to the Child Tax Credit (CTC) enacted in the American Rescue Plan Act (ARPA). It would make the CTC fully refundable beginning in 2024, and for 2024 and 2025 increase the age limit from 16 to 17. Additionally, it increases the maximum credit per child to $3,600 for children under 6, and $3,000 for older children, phasing out at 5% of income in excess of a threshold dependent on filing status: $150,000 (married joint), $112,500 (head of household), and $75,000 (other). These amounts are not inflation-adjusted.

For example, this reform would provide an additional $3,600 to a single parent of two children, with one below six, if their income is below $6,600. The net benefit would phase out until their earnings reach $164,000, as shown

To learn more, read our

Restoring the 2021 Earned Income Tax Credit expansion for filers without qualifying children#

Biden similarly proposed restoring ARPA’s expansion of the Earned Income Tax Credit (EITC) for filers without qualifying children. His plan would:

-

Increase the phase-in and phase-out rates from 7.65% to 15.3%

-

Lower the minimum age from 25 to 19 (or 24 for students)

-

Remove the maximum age, currently 65

-

Raise the maximum credit from $632 to $1,749 (adjusted for inflation from 2021)

This would change the EITC

Producing a net benefit of up to $1,360 at $13,500 earnings, phasing out until earnings reach $25,000.

To learn more, read our

Increasing the top marginal rate to 39.6%#

The President proposed raising the top marginal tax rate from 37% to 39.6%, its value prior to the Tax Cuts and Jobs Act of 2017. The new rate would apply to income above $400,000 for single filers, $425,000 for head of household filers, $450,000 for married filers, and $225,000 for married separate filers. The reform would take effect in 2024, and the thresholds would rise with inflation starting in 2025.

For a

Increasing the Medicare and Net Investment Income taxes#

Finally, the President proposed increasing both the top Medicare tax rate and top Net Investment Income Tax (NIIT) rate by 1.2 percentage points for individuals with income over $400,000. Since this is based on wages or net investment income, it kicks in at $400,000, not the higher amount resulting from the standard deduction. For an

Provisions not modeled#

The Budget introduces four additional individual income tax reforms that PolicyEngine does not yet model:

-

Applying the NIIT to pass-through business income of taxpayers with income above $400,000

-

Tax long-term capital gains and qualified dividends as ordinary income for filers with taxable income above $1 million

-

Repeal “step-up basis” that increases the basis of inherited assets to the value at inheritance

-

Impose a minimum tax of 25% on total income (including unrealized capital gains) for taxpayers with wealth exceeding $100 million

Additionally, it reforms some of the programs we model in additional ways, such as a monthly CTC advance, and introduces many reforms outside the individual income tax. As we enhance our model, we will be able to forecast impacts of these types of reforms.

Combined household impacts#

To see the combined impacts of all four reforms on net income and work incentives, we examine two household types: a single person and a married couple with two young children.

Single person#

The

Their

Family of four#

A

The reform increases their

Nationwide results#

We run the PolicyEngine tax-benefit microsimulation model v0.717.0, using our

These provisions together would cost

The net income of the bottom nine deciles would

As a

Three in five Americans would see an

The Supplemental Poverty Measure would fall 12%, disproportionately among

Conclusion#

President Biden’s proposed individual income tax reforms in his 2025 Budget, as analyzed by PolicyEngine, would have notable impacts on American households and the economy. The restoration of the expanded Child Tax Credit and Earned Income Tax Credit from the American Rescue Plan Act, along with the proposed increases in the top marginal tax rate, Medicare tax, and Net Investment Income Tax, are projected to result in a net cost of approximately $41 billion in 2024 and $35 billion in 2025.

The analysis suggests that the reforms would have a progressive impact on income distribution, with the bottom nine deciles experiencing an average increase in net income, while the top decile would see a decrease. The proposed changes are also projected to reduce the Supplemental Poverty Measure by 12%, with varying impacts across demographic groups. Income inequality would also be affected, with reductions ranging from 1.7% to 2.7%, depending on the measure used.

This analysis does not account for potential behavioral responses to the proposed tax changes, and differs from Treasury’s budgetary estimates for reasons described below (Treasury does not provide distributional estimates). As policymakers and the public consider these reforms, it will be crucial to carefully examine the potential impacts and trade-offs associated with the proposed changes to the individual income tax system.

Appendix A: Budgetary breakdown#

This table compares PolicyEngine’s estimates in 2024 and 2025 to those of the Treasury Department.

Table 1: Effect of Budget Proposals on Projected Deficits ($ billions)

Due to timing considerations — we place the budgetary impact of tax credits in the tax year, while Treasury does so only when paid in advance, mirroring the delivery of most payments in the following year — the combined impact across years provides more comparable numbers than either year in isolation. Here, Treasury estimates $94.4 billion from 2024–25, while PolicyEngine estimates $75.2 billion. This does not fully account for timing considerations, since Treasury allocates part of our 2025 estimates to 2026.

Other deviations could result from multiple causes. For example, we do not model the provision to apply the NIIT to pass-through business income of high-income filers, which occurs prior to the NIIT increase; accounting for this would thus increase our estimate of that provision. Further calibration of our

Riley Kotlus contributed to this report.

max ghenis

PolicyEngine's Co-founder and CEO

pavel makarchuk

Economist at PolicyEngine

Subscribe to PolicyEngine

Get the latests posts delivered right to your inbox.

© 2025 PolicyEngine. All rights reserved.