Technical Documentation

US Model Documentation

Technical details about the US Enhanced Current Population Survey (ECPS), tax and benefit calculators, and validation methodology.

Enhanced CPS Documentation →UK Model Validation

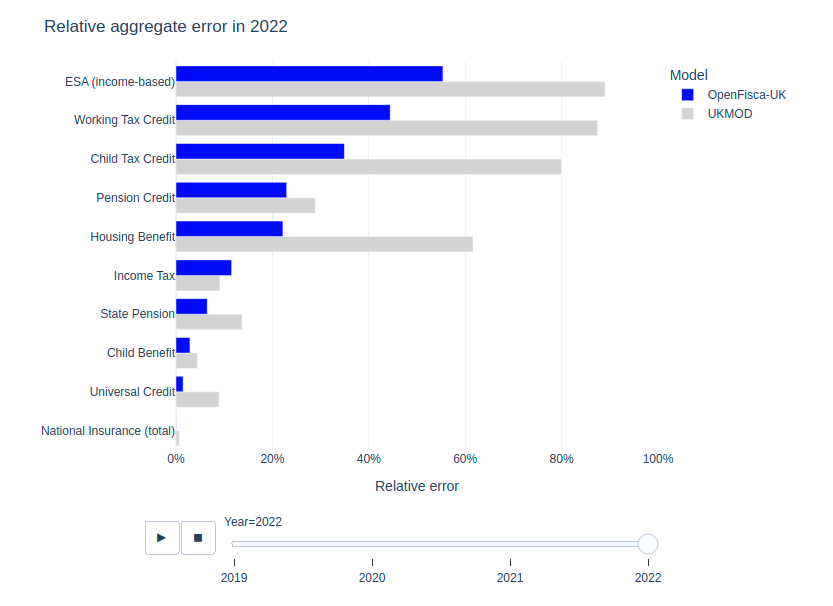

Detailed information about the UK tax and benefit model, including data sources, calibration methodology, and validation results.

UK Model Validation →GitHub Repositories

Access our open-source code repositories for all PolicyEngine models, including tax-benefit rules, data processing pipelines, and web interface.

PolicyEngine on GitHub →